We started Instamojo to help small & micro-merchants (MSMEs) make digital payments since incumbents wouldn’t. Also, there was a feeling of resentment and discontent since I was one of them and experiencing the same issues.

More so, existing systems and processes were not geared for MSMEs to transact digitally — starting from IT and technical requirements, paperwork and documentation, integrations and installations with a functional website / mobile app or even opaque pricing structure were geared rightly for large enterprise merchants who had time, resources and money.

And rightly so! MSMEs by nature are small, fragmented and diverse; hence posed as high-touch, the expensive and risky opportunity to incumbents.

The need for digital payments in India

At the same time, India was touching 50+ million MSME’s and growing. And to tap into this opportunity, it required a fresh new way of acquiring, serving and monetising.

That was our moment! As they say, one man’s loss is another man’s gain. We looked at the size of the digital enablement opportunity and gave it a shot.

After 6+ years, we have 150,000+ MSMEs and feel that we haven’t even scratched the surface. The single biggest reason we went on to become a leader in enabling digital commerce & payments for Indian MSMEs is “abstraction“. Let me elaborate:

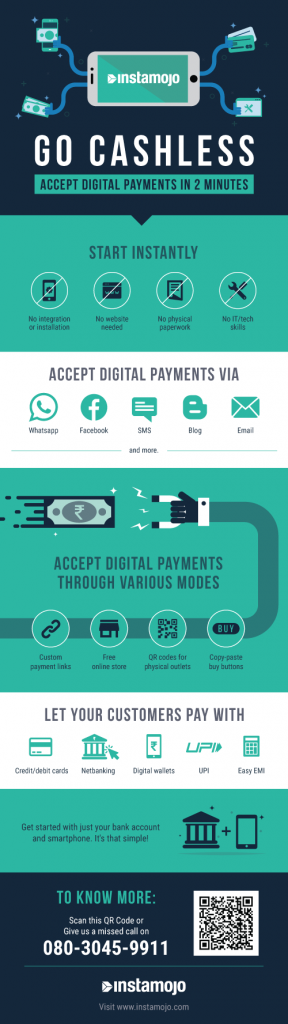

To get started with Instamojo.com, you just need a phone and a bank account. That’s about it.

– No website or mobile app needed

– Integration or installations of any kind not required

– No physical paperwork

– No special IT or tech skills needed

– Transparent payment gateway charges

– Finally, simplest and fastest onboarding ever — just 2 minutes (yes you read it right).

So today, it gives me immense pleasure to introduce the quickest & fastest way to “Go Cashless in 2 minutes with Instamojo“. Check out this Payments via WhatsApp video to know more!

Why use Instamojo for online payments?

Also, there are a few added advantages of being a part of Instamojo’s digital payments platform.

– There’s no monthly restriction on payments collection, unlike others. In short, you can collect 10,000 per month or 10,00,000 per month – it’s up to you.

– Your customers can pay with any mode like credit/debit, net-banking, wallets, UPI, easy EMI.

– All sale proceeds (deposits) go directly to your bank account.

– You benefit immensely from various service providers through Instamojo Appstore in 1-click.

Here’s an infographic to help you (click to see bigger image):

Feel free to share this infographic by embedding on your site (copy code below):

<p><strong><a href=’http://blog.instamojo.com/2-minute-instant-onboarding-to-accept-digital-online-payments/’><img src=’https://blog.instamojo.com/wp-content/uploads/2016/11/Go-Cashless-in-2-Minutes-Instamojo.com_.png’ alt=’Go Cashless in 2 minutes with Instamojo’ width=’540px’ border=’0′ /></a></strong></p>

1 comment

This site is digital payment system…I like this page and get more information..