Just a few months ago, we asked a small dry cleaning shop owner what his biggest business challenge was. Without hesitation, he said “GST.” Several businesses have a problem with understanding the tax and explaining it to their customers. To solve this problem, we teamed up with ClearTax.in to craft a GST course on mojoVersity.

GST problems among small businesses

When the Goods and Services Tax was launched in 2017, the MSME sector received it with mixed feelings. While it reduced the number of indirect taxes a small business had to pay, it also came with multiple return filings and a complicated invoicing mechanism.

The system became transparent but brought with it some challenges. Here are some of the most popular ones:

- Confusion on who should register for GST

- Is GST registration compulsory?

- How and when to file returns

- What to do in case of wrong returns filed

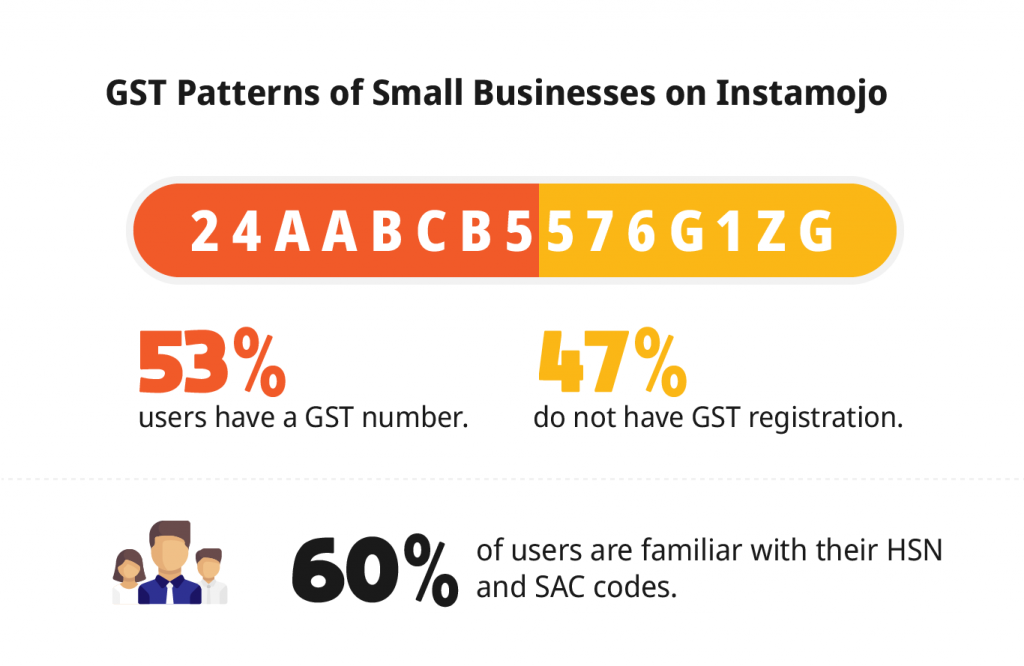

We also ran a survey on small businesses on Instamojo to understand the State of GST in India. Here’s what we found:

What’s more? We found that a large number of these businesses just outsource their return filing to Chartered Accountants or use third-party software to file returns.

Only 15% of sellers file returns on their own on the GST portal.

It was clear that most businesses were still struggling to understand how GST worked or how it applied to their business.

GST Solution: FREE GST Course powered by ClearTax

This led us to team up with ClearTax.in – India’s number 1 tax-filing platform. In collaboration with the tax expert, we launched a basic course on GST on mojoVersity that would help a business understand:

- If GST applies to your business

- Various slabs under GST

- HSN/SAC Codes and TDS/TCS

- How to register for GST if applicable to your business

- Filing GST returns

- How to correct Invoices in case of data mismatch

- Advance rulings of GST

With this course, we hope to help businesses understand GST better and help with any compliance assistance they might need when enrolling or managing their GST requirements.

“MSMEs find it challenging to understand and implement GST and adapt to them quickly. Instead of letting that be a barrier to their business, we are coming together with Mojoversity to provide direct access to high-quality online learning content created by ClearTax which will help MSMEs comply to GST norms with ease.” – Archit Gupta, Founder & CEO, ClearTax.

Why Choose this GST Course?

There is a lot of GST content available online that will be difficult to comprehend. GST laws are also dynamic and need constant reading up – which means spending hours consuming pages after pages.

You should choose this basic course on GST because:

- This basic course is in short video format. You can complete the course in 1.5 Hours

- This course is crafted by India’s no.1 tax platform – ClearTax.in

- There is a quiz at the end of the course to test your knowledge of GST

- You get a verified, downloadable certificate by ClearTax and mojoVersity on course completion

- IT’S FREE!

How mojoVersity Works:

All courses on mojoVersity are short, crisp, and crafted by industry experts to help you be the best at what you do. All you need to do is:

- Sign up with email

- Enroll in any course for FREE

- Log-in any time you want from any device to watch the videos

- Take a quiz at the end of the course

- Download your verified certificate on course completion

Become a domain expert in under 60 minutes! Get started with your learning experience on mojoVersity today.

2 comments

thank for the link

by the way

i am a graphic designer freelancer and would like to help you some day

Thanks so much for this! I LOVE the tips you provide for free!