Digital payments in India are seeing it’s best growth period. A KPMG report published recently stated that digital payments in India are seeing a compound annual growth rate (CAGR) by 12.7%* – and is expected to grow up to 20% by the next financial year.

The primary reason for this? Mobile payments in India saw a massive movement among small merchants in the last few years. Between 2016-2019, over 10 million merchants in India adopted digital payments.

Could it be because of mobile payments alone? Or have other modes of online payments helped?

The Government and RBI have made significant developments to online payments in order to make it easier for small businesses to get on board. With the 2019 Union budget, the Government sought to promote digital payments in the country by:

- Absorbing MDR charges

- Increasing ATMs in rural areas

- Introducing digital POS machines in Kirana stores

The global digital payments market is expected to grow up to 10 trillion USD by 2026. India could easily account for a third of that contribution!

Why do small businesses prefer mobile payments?

Over 70% of Indians own a mobile phone. Of these, over 400 million users use their mobile phone to make online payments. Mobile-based transactions in India have increased 40 times in the past five years.

As per RBI forecasts, there is an expected 50% increase in mobile-based payments in it’s ‘2021 vision document’ for digital payments.

Mobile payments are easy. Here’s why small businesses prefer mobile payments:

Payments on the go: Small businesses do business remotely. To collect payments on the move, mobile payments are the best option. You can use mobile payments anytime, anywhere.

More options for small businesses: including mobile-focused payment options like UPI and QR codes. Customers too have different options to make payments to the merchant.

Safe, secure and fast: Faster checkout process for customers helps businesses collect payments faster. It is also safer and more secure than other modes of online payments

Easier bookkeeping: With mobile payments, small businesses can reduce costs such as bank charges and overheads and can better evaluate their cash flow position.

Best Mobile Payment Options for Small Businesses:

Small businesses are already embracing mobile payments. All forms of payments have gone mobile. Here are some of the mobile payment tools that are most popular among small businesses in India: –

UPI:

The introduction of UPI led to a wave of digital payment growth in India.

RBI’s annual report states that in 2018-19, UPI payments took over debit/credit card transactions in India.

Over 5.35 billion UPI transactions took place in the last financial year, compared to the 4.41 billion card transactions.

Why are businesses preferring UPI over other modes of payments?

UPI is a mobile payment feature that allows for P2P (peer-to-peer)and P2M(peer-to-merchant) transactions. The money is directly transferred to your bank account. Easy, safe and no extra documentation needed.

Also read: What do small businesses want from UPI?

NEFT/RTGS:

Banks have net banking apps that allow you to make and collect payments using NEFT, RTGS or IMPS modes of payment.

According to this report by Capital Minds, NEFT is the most popular method to collect payments in India. The report claims NEFT transaction volume went up to INR 200,000 CR in the last two years. Customers and businesses use NEFT and RTGS to make quick, large sum payments from their phones. With the recent decision by RBI to remove transaction charges on NEFT and RTGS, more businesses are expected to use this mode of payment.

Digital Wallets:

As per the KPMG report, a prime factor that revolutionised mobile payments in India was digital wallets. Why? Digital wallets like Paytm, PhonePe and Mobiqwik are convenient, quick and offers inter-operability to merchants.

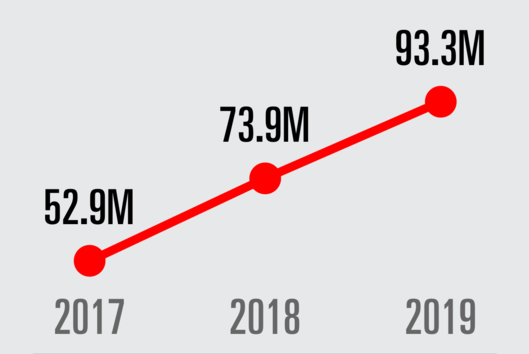

The mobile digital wallet market is expected to continue its expansion at a CAGR of nearly 52.2% by volume during 2019-23.

Instamojo facilitates all modes of online payments for small business merchants; from UPI, debit/credit cards, digital wallets and even NEFT/RTGS transactions.

Start collecting payments with Instamojo today!