Are you an entrepreneur unsure of how to leverage UPI payments for your business? With a brand new outlook and a merchant-centric vision, what does the future of UPI offer? Let’s find out.

UPI transactions have crossed the 300 million mark in August, according to the NPCI. At Instamojo too, we saw a 10% growth in UPI transactions in August as compared to July.

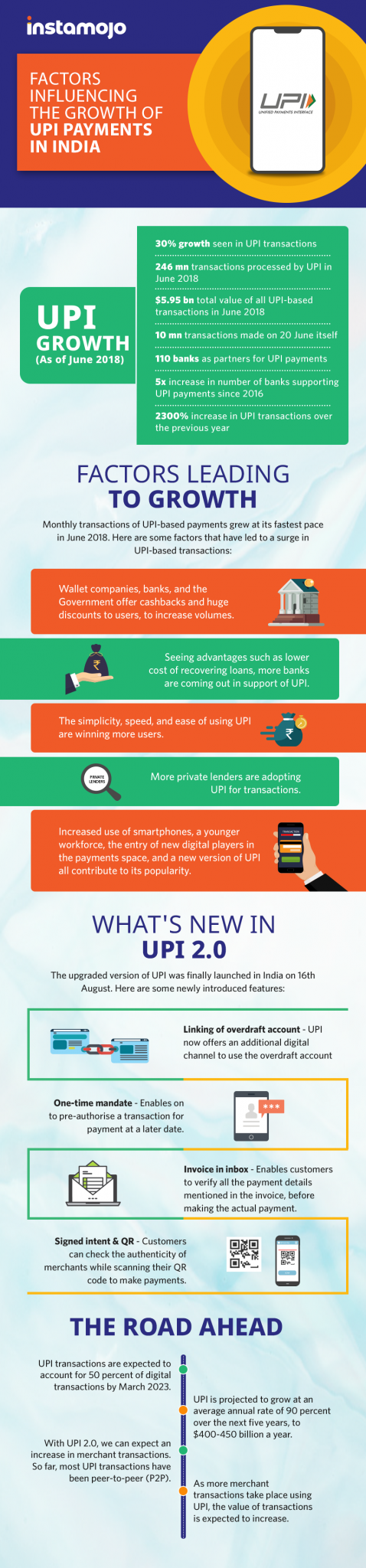

Factors pushing for the spike in UPI payments:

- As an incentive to promote UPI payment mode, wallets, banks and, even the government are offering huge discounts and cash back.

- More private lenders, merchants, and consumers are opting to use the app, due to its various advantages.

- A large percentage of the current population, use smartphones. These smartphones can also be used to access and use the app for payments, making it accessible, more than ever.

How are UPI 2.0 payments different from UPI 1.0?

One could use UPI 2.0 to book a taxi, pay for groceries, or purchase equity investments. UPI 1.0 was largely a person-to-person payment mode and lacked features that could support businesses. With its new version, NPCI hopes to make the feature more business-friendly.

To know more about the features of the UPI payments app and how it can affect your business.

The Future of the UPI payments:

Given the month-on-month growth in UPI transactions, it is predicted to cover over 50% of all digital payments by March 2023. In the future, we should see:

- More banks coming out in support of UPI. Currently, there are 39 banks that support UPI. You can view the entire list here.

- An increase in merchant transactions, given UPI 2.0 is super merchant-friendly.

- The value of UPI transactions increasing as merchants/businesses deal in bigger ticket size transactions.

- UPI spreading to more Asian countries? PM Narendra Modi had earlier launched BHIM in Singapore. We could see the mode expanding to other countries.

Did you know you could collect payments with UPI even without a Virtual Payment Address for your account?

With Instamojo, you can not just collect payments with UPI but also several other modes like credit, debit cards, NEFT, wallets, and even EMI! Track all your transactions and payments on a simple dashboard with Instamojo.

Start your Instamojo experience today!

4 comments

Great Infographic presentation, Surprised to know about UPI Payments future in India. I also want to know about best UPI integration for Individuals.

Almost every merchant is accepting UPI Payments. By the way, your infographic is just awesome. Liked the branding inside infographic and color combination is great. Keep up the good work!

The only issue I see is arbitrary limits the banks have set on cumulative UPI transactions per day. Though NCPI says 1 lakh rupees per day as the limit, banks have set abysmally low limits. For example, ICICI Bank has reduced the cumulative transaction limit per day to just 25,000 INR. Imagine a client who needs to make a payment of 50,000 INR for services. What use will UPI serve in his case? I think a clear limit should be set by NCPI and banks must strictly adhere to it.

Stunning infographic. Amazing to know that UPI will grow at a rate of 90% annually.

Out of curiosity, which tools did you just used to make this infographic