Mastercard and VISA cards, move over! Made in India – RuPay – is here to take the digital payments sector by a storm. According to the NPCI (National Payments Corporation of India), RuPay cards and UPI have together gathered 60% of the market share of digital transactions in India!

What’s better?

RuPay has changed the way India sees digital transactions. More than 560 million people hold RuPay cards today.

What the numbers say:

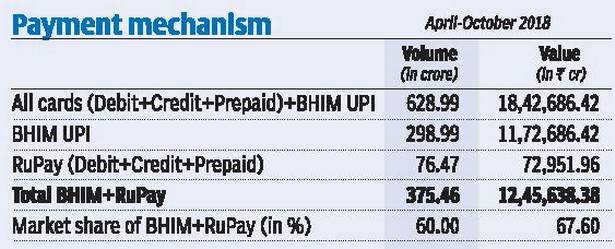

As per the records of NPCI, from the months of April to October, over 600 crore transactions took place via debit, credit, prepaid cards, and BHIM UPI of which 76 crores were RuPay transactions alone!

But what is RuPay and why is it garnering so much attention these days?

5 Things You Should Know about RuPay:

RuPay Desi Card:

RuPay is a domestic card developed by the NPCI to promote digital financial adoption in India. While Visa and MasterCard are foreign interchange networks that issue Debit and Credit Cards, RuPay is completely Indian and comes equipped with high-end chip technology that ensures safe transactions.

RuPay Fast Card:

RuPay cards process data super fast as the data is routed through Indian servers for verification. In the case of VISA and MasterCard, all payments data is first sent to their servers abroad for authentication.

RuPay Cheap Card:

One of the best things about RuPay cards is their low processing costs and operational charges – they’re cheap because it is homegrown. Banks usually pay a service charge to VISA and MasterCard to process transactions. Since RuPay is local, the charges are relatively lower.

RuPay Popular Card:

Since RuPay is relatively new in the payments sector, the NPCI has made it available in most public and small, cooperative banks. They are also available in select private banks. More recently, Prime Minister Narendra Modi launched RuPay Card in Singapore.

RuPay Gift Card:

RuPay cards almost always have some interesting offers and cashback running with partners like GrabOn and Big Bazaar. It also offers GST Cashbacks to customers!

Why is RuPay so exciting?

- Lowered processing fees – Transaction fees lesser than Visa and Mastercard

- Acceptability – These cards are accepted at 1.45 lakh ATMs, 26.14 lakh POS terminals and e-commerce websites.

- Super Safe – These cards are likely to be more secure as they come with EMV (Europay Mastercard Visa) chips. This reduces the risk of fraud drastically.

You can allow your customers to pay you with RuPay cards on Instamojo too. With Instamojo payment links, you can let your customer choose to pay you with any payment mode – Debit or Credit Cards, NetBanking, Wallets, UPI and even NEFT!

Take your business online with Instamojo!

1 comment

Visa and Master Card is usable Internationally. On the other hand we can’t use RuPay Cards for international payments.