There are 1000 things to worry about when setting up your small business but one of the most important things is to operate legally in the country.

It’s always good to have basic legal knowledge when running a business. Here are some major small business law categories that you need to take care of regardless of the type of business you are running.

Contents

Company Formation Laws

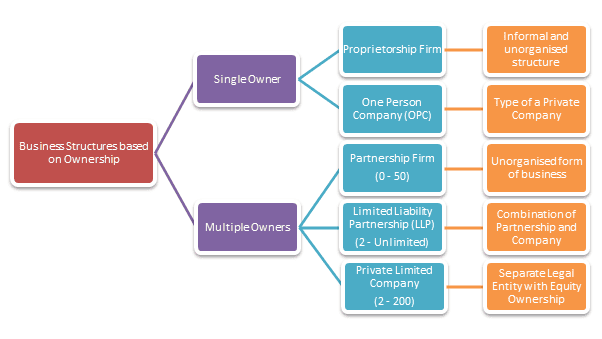

While starting up, you need to choose what type of company you want to run. If you know what kind of long term profits you are expecting, and the scale of business that you want to run, then you can decide on a legal structure for your business.

The legal structure of your business is going to determine the tax you pay, the paperwork you need and the ability to raise funds.

Here are the different legal structures you should know about when starting a business:

- Sole Proprietorship

- Partnership

- Limited Liable Company

- Corporate

- Co-operative

Different legal structures adhere to different company formation laws. The Indian Companies Act, 2013 states laws for each type of company.

There are various pre and post-incorporation requirements that you need to complete while setting up your business, starting with registering your company with the Ministry of Corporate Affairs.

If you are a start-up with an innovative idea, you can also register wth Startup India from home itself. Here’s how.

Business Finance Laws

Largely, there are three types of funding:

- Equity financing – investors have shares in your company

- Debt financing – you take out a business loan

- Self-financing

If you are getting equity funding from Venture capital firms or angel investors you need to have documents like – a letter of intent, share subscription agreement and shareholders agreement – all chalked out.

If you are getting debt financing (borrowing a loan from a bank) you need to get an application for loan sanction papers, sanction letter, loan agreement letter and collateral documentation in place.

Also read: Looking to raise funds? Check out this guide

Tax and Accounting Laws

As citizens of India, your company should be aware of the tax categories it falls in. If your business has a turnover that exceeds Rs 40 Lakh then your business needs to first register for the Goods and Service Tax.

Based on your business structure, you will also have to file taxes. We now have a simplified tax structure that has subsumed a number of taxes into one central tax.

Here are some resources to understand GST and how it affects your business:

- Everything you need to know about new GST return in 2022

- GST E-Invoicing: How to Leverage It For Your Small Business

- The Impact of GST on your eCommerce Business: 3 Things to Know

Securities Laws

Did you know that you can list your small business on the SME stock exchange, regulated by the Securities and Exchange Board of India, without having to launch an Initial Public Offering (IPO)?

Check out this article by Tax Guru to know more about SME exchange.

Labour / Employment Laws

If you plan on hiring people or have people working for you, you must have employee agreements and abide by the labour laws.

This includes employee privacy rights, federal regulations, disability, and discrimination acts etc.

Intellectual Property Laws

If your business is involved in creating something new – code, products, design etc – you might want to put your name on it. In other words, you should copyright, patent or put your trademark on it.

Doing this will help you avoid intellectual property theft and also give your profitability a boost via royalties!

Information Technology Laws

Technology stands at the core of any business today. You might be using and exploring all sorts of tech to improve business. As powerful as technology is, it is also vulnerable.

Therefore, the Government of India has introduced the IT Act – cyber laws that help protect online privacy and identity.

Dispute Resolution & Contract Laws

All of the above points thrive on contracts. You are signing an agreement where both parties are agreeing to a certain condition. Sometimes, if not communicated rightly, agreements can quickly turn into disagreements and result in a dispute.

There are several contractual and dispute resolution laws that can help you protect your business and run it smoothly.

LEGALWIZ – Your perfect advisor for anything legal

Are you tired of reading up on various small business laws without being able to execute them easily? We have an idea about where you can start.

We collaborated with LegalWiz, a leading business professional services provider in India, to help businesses get acquainted with expected day-to-day interaction with business law.

7 comments

Can I distribute companies profit as multilevel on public in E-COMMERCE field.or any rule or law

Suggest me on my email – azim.idrisi15july@gmail.com

It is very important to know the small business laws otherwise we can face different problems regarding our business. Thank you Rapti Gupta for this nice blog post regarding the small business law.

Very Informative. Keep it up.

i have to be a dealer by procuring the chemical from indian manufacturer and give it to a pharma company in U.K

They pay me and i supply to them , there delegate will come and collect the chemical the deal is good , since i am not into any of the business , i have come across this deal from my friend the U.K who is working in the same pharma company

Transactions is in around $60lakhs , how to deal legally without any conflicts

hii,

can u please explain followings act in detail

1) Indian Contract Act ,1872

2)Indian Sale Of Goods,1930

3)Negotiable Instrument Act,1881

4)Consumer Protection Act 1986

Thank you

Its a very insightful blog post.Thanks for the share!

I too have a blog post on basics of setting up a business in India-policies. Give it a read too! Thanks for the wonderful post.

Good to see your blog on Indian business laws, startup knowledge and related informations.

Business oriented people will connect us regarding cloud-based bookkeeping software and GST ready business accounting software for small and medium enterprises.

Thank for sharing.

Regards,

AlignBooks