Optimism is the anchor that can make your ship sail through the turbulent waters. 2020 has been the toughest for the global economy, but many small businesses have braved it all, giving us a ray of hope.

“MSME sector contributes 30% to GDP and export from it is 48%. Presently MSME is the most important sector for the country, I say it’s the backbone of Indian economy,” – Nitin Gadkari, Union Minister of MSMEs

Data shows that MSMEs have the resilience to endure tough times and bounce back stronger. A survey by American Express India and YouGov recently confirmed this fact. Four out of five businesses believe their business will survive even if the pandemic continues.

So how did the Indian small business pull through the most difficult and testing period?

What helped small businesses brave the pandemic?

#1 Innovation

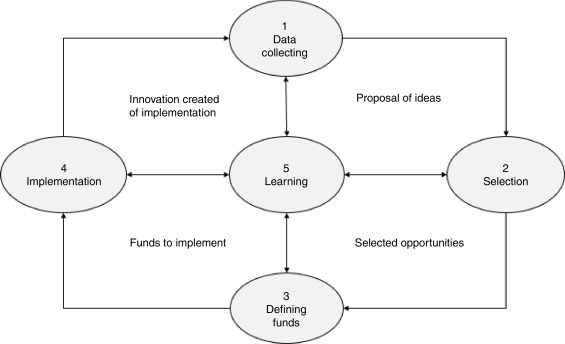

COVID-19 saw the rise of innovative solutions from entrepreneurs to sustain and survive. Some businesses incorporated innovation in their product offering as well. For instance, researchers in IIT-Delhi developed the world’s most affordable COVID testing kit ‘Corosure’ in July 2020.

The power to innovate and think out of the box to gain the consumers’ trust during these unique times kept the MSMEs optimistic and confident.

Also Read: Innovation at the time of COVID – How these Indians came through during a tough time

#2 Government initiatives

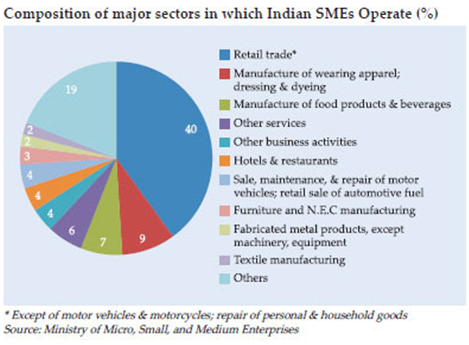

MSME sector is the second-largest employer in the country after agriculture with more than 12 million shops, states a Nielsen report.

While there is certainly much scope to do more, timely and strong support from the government also helped the SMBs.

International Monetary Fund’s head Kristalina Georgieva observes that “India’s below-the-line stimulus (equity, loans, guarantees) has been better than the average developing countries during the pandemic.”

Some notable initiatives by the Government are Champion Portal, which provided a platform to anyone who has a business idea to pitch their business and acquire funding or investors interest, and Emergency Credit Line Scheme.

Also Read: How has the ECLGS helped MSMEs so far?

#3 Support from consumers #I local

local

This year saw small businesses getting support from the Indian consumers too. This meant consumers chose to buy from a local seller over a popular brand.

According to the Unicommerce report, over 78% of new buyers preferred buying from small businesses. Campaigns around ‘Handlooms’, ‘Vocal for Local’ and ‘Made in India’ were a big hit. They encouraged a shift in buyer behaviour and pushed small businesses to take the online route to boost sales.

#4 Going online

Small businesses increasingly optimised the use of social media to promote their products and services and increase sales. With COVID-19 shutting physical shops, many small businesses pivoted to start their online journey.

A survey by Bluehost found that more than half of the businesses surveyed observed growth in their online traffic. 9 out of 10 respondents felt it is vital to selling online.

In India, over the last year, order volumes on the ‘Amazon of the Government’ – the Government e-marketplace has increased by 89%.

Read: How you can sell your products/services on the GeM platform

#5 Digital-first approach

The outbreak of the pandemic proved to be a major catalyst for many small businesses in adopting end-to-end digital services and sustaining the recovery stage.

According to the Visa Back to Business study, 78% of consumers have changed their shopping habits in the wake of COVID-19, including shopping online whenever possible and using contactless payments at checkout.

This implies an increased need for contactless experiences and affordable payment options at the point-of-sale (online or in-store) for the customer will continue to improve the buying power, especially during the recovery phase.

As per an EY survey ‘Sentiments of India – Pulse of the country, Kiranas’, 40% of small business owners are now open to partnering with online delivery and supply platforms.

Want to take your small business digital? Start with Instamojo!

To be successful, small businesses need smooth processes like business payments, inventory, sales order and fraud management, etc. Efficient partnerships between fintech, big technology players, and payment networks are also critical for their success.

Instamojo provides an all-round digital solution for your small business to grow and scale. With Instamojo you can:

- Create an online store – mojoCommerce

- Get access to instant credit – mojoCapital

- Set up payment links and collect payments without any hassle – mojoPayments

- Get shipping support for your products – mojoXpress

- Sign up for free courses designed exclusively for business owners – mojoVersity