Have you enrolled for the Goods and Services Tax yet? The last date to enroll for GST is April, 30, 2017. If you haven’t already completed GST registration, here’s a step-by-step guide on how to enroll your small business for GST.

Contents

Step 1:

Contact your State VAT department (online) to get your provisional username and password.

Step 2:

Log on to https://www.gst.gov.in/ and sign in with the provided creds.

Step 3:

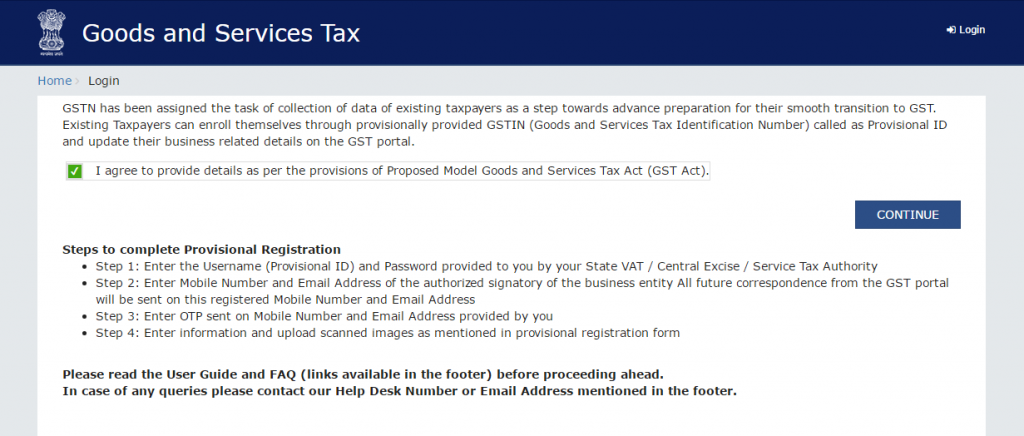

Click on New User Login and check the “I Agree” box on the Declaration Form.

Step 4:

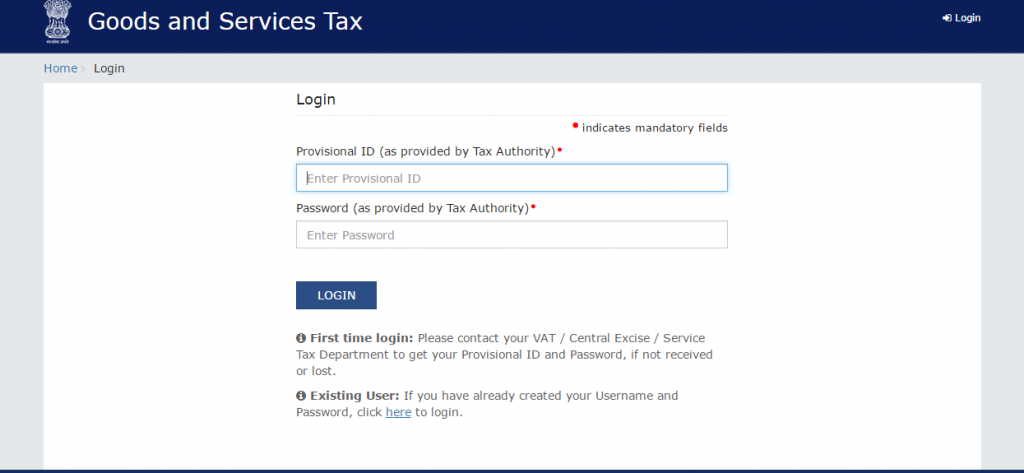

Login with your provisional ID and password and fill out the details.

Step 5:

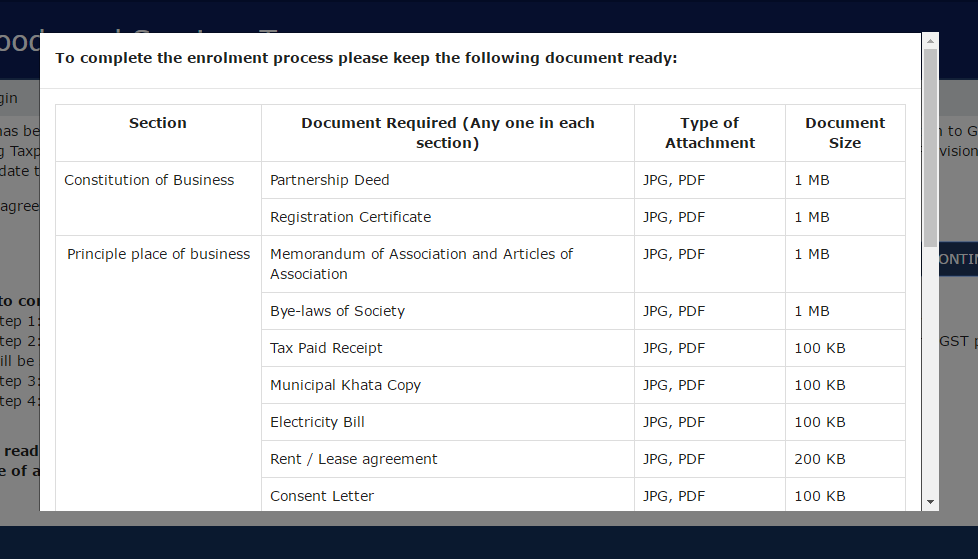

Keep the following documents handy:

- Bank Account Number with IFSC Code,

- Proof of Business Documents (partnership or LLP deeds),

- Photographs of you/partners

- Letter from Authorised Signatory

- Bank Statement.

All in (PDF of JPEG Files not exceeding 100KB – 1 MB)

Step 6:

Continue to Login with the provisional ID and Password. You will be taken to a page where you have to fill out a valid email ID and phone number.

Please note this will be stored in the GSTN (GST Network) servers and act as your point of contact to communicate further information.

Step 7:

An OTP will be sent to the number. Enter the OTP to authenticate number.

Step 8:

You will then be redirected to a form where you will be required to fill in personal details and change the provisional password.

Step 9:

You will then be taken to a dashboard with several tabs. Click on ‘Provisional ID Enrollment’ in your dashboard and fill out all the 8 tabs accurately.

Step 10:

Attach your Digital Signature Certificate in the Verification tab.

How to attach digital signature? You can verify it with the Aadhaar Number of the Authorized Signatory.

Step 11:

Once verified, you will receive an Application Receipt Number (ARN) via registered email ID. You can download your GST certificate from the GSTN portal in your dashboard once it is issued.

Check out the steps in this video below:

If you are an Instamojo merchant, you can register with our GST partners for a smoother GST transition. Click on the button below to get started with GST registration in minutes!

Disclaimer: Information in this article is intended only to provide a general overview and is not intended to be treated as legal advice. Please consult a tax expert to get a better understanding of the GST Laws.

14 comments

Well, great information and such a great post

I was looking for an authoritative content on “GST Registration” and this article accurately explains the concepts relating to the same. It is an understandable, informative and a very well written content piece.

Very informative content by Ms. Rapti Gupta, Keep on writing such articles, great going thumbs up!!!!

Yeah, it is very helpful for knowledge of GST registration. I hope visitors will get a full process of GST registration.

Hello !!

Thanks for sharing good information….

Hello Rapti,

I have a doubt. Should we register for GST for selling products at Instamojo even though our sales revenue is less than the threshold limit?

Very good information you shared for small as well as enterprises.

Thank you very much for the information you shared here.. its easy to understand and clear information on How we need to get register for GST. Thank you.

Jyothsna Srinivas

Thanks for sharing such a great information. You have written it very well and easy to understand.

Thanks for amazing post, Information is very use for GST and easily understand.

Thank you very much.

the information detailed is easy and helpful to understand

You put great information about GST enrollment for small business in India.

Business oriented people will connect us regarding cloud-based bookkeeping software and GST ready business accounting software for small and medium enterprises.

Thank for sharing.

Regards,

AlignBooks

Hopefully, it will be beneficial to India. Thanks for sharing.

Hey Rapti,

Thanks for such an amazing post. You have explained everything in a clear way that even an illiterate can understand easily.