The Indian government is facing a ₹ 2.35 lakh crore GST shortfall. If you have not received your GST returns from the state or the centre it is because of the coronavirus. Read on to know how the shortfall is impacting businesses and what you can do to manage GST problems for your business.

Why is there a GST shortfall?

When the Goods and Services Tax was implemented, the central government assured the state governments that any shortfall in the tax revenues would be compensated to the state via a compensation cess fund.

Normally, the compensation cess fund could be used when any state ran into a tax deficit due to GST implementation problems. Since the COVID-19 pandemic is not an implementation problem, reports suggest the cess fund hasn’t been touched yet.

The centre is cash-strapped just like the state governments. Collectively, the gap amount stands at ₹2.35 lakh crore today!

The centre has proposed the states borrow the shortfall amount at low-interest rates or get part of it paid under the compensation cess. Around 13 states including Bihar, Uttar Pradesh, Odisha, Andhra Pradesh, and Meghalaya have accepted the borrowing plan but the options are yet to be finalised.

Reasons at a glance:

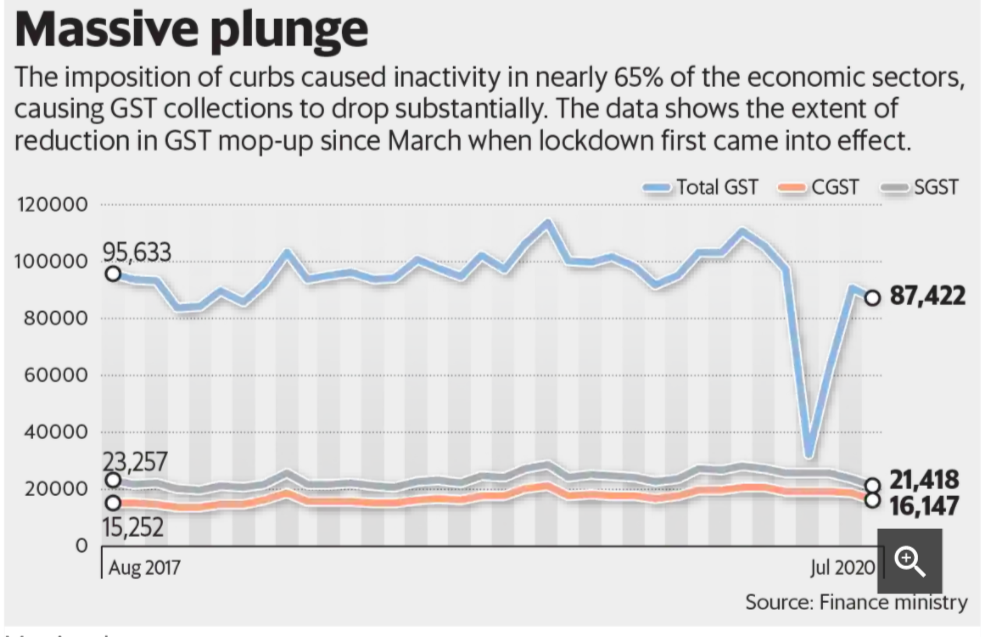

– Tax revenue at the center and state suffered due to COVID-19, low economic activity

– Since COVID-19 is an “Act of God,” Compensation Cess fund hasn’t been touched yet

– Poor GST invoicing and GST fraud

Also read: The State of GST in India

How is the GST shortfall impacting MSMEs

MSMEs are already grappling with a weakened support system since COVID impacted business. A GST shortfall will lead to –

- Slow to almost no revival for COVID impacted small businesses. Government schemes provided by the state will not help MSMEs bounce back and resume operations on time.

- No GST returns could mean stuck cash impacting working capital.

- If the states accept the centre’s proposals of borrowing the shortfall amount, the interest burden could fall on the small and medium businesses (MSMEs), which could make it difficult to operate.

How to solve GST problems for your business:

GST can be tough to handle.

“The major strain on cash flows for MSMEs comes from GST payments, as we are forced to pay for our supplies irrespective of our overdue payment dues,” S. Vasudevan, joint secretary of the Tamil Nadu Small and Tiny Industries Association was quoted in The Hindu.

If you have been struggling with GST due payments, we have a couple of recommendations that can help you sort things out financially. Let’s get right to it:

- Always maintain correct invoices, clean records to meet your operational requirements. In fact, we have an ebook you can refer to for smart tips on how to handle cash flow for your business. Download it here.

- Understand the basics of what GST means for your business. What rates, forms and deadlines apply to your SME? How do you claim for an Input Tax credit? How do you upload digital GST invoices to avoid fraud? If you have questions regarding GST, then you NEED to understand it perfectly.

mojoVersity, our e-learning platform exclusively for MSMEs and entrepreneurs, offers the perfect course for anyone who needs to understand GST for business. All you need to do is sign up and enrol! It is completely FREE and offers case studies to help you understand it better.