From February 1, 2020, online payments with UPI, RuPay are mandatory for all businesses with an annual turnover of ₹50 crores or more. Failing to do so can attract a fine of ₹5000 per day!

In a bid to promote online payments and bring in transparency, the government has urged businesses to include the following payment modes for customers:

- BHIM UPI – Unified Payments Interface

- RuPay Card

- UPI QR Codes

- Aadhar Pay

According to a news update by Business Today, Finance Minister Nirmala Sitharaman also proposed to insert a new section into the Income Tax Act (269SU). Under this, businesses have to pay a fine of ₹5000 per day – if they do not adopt the recommended online payment modes.

Why should your business adopt online payments?

The Central Board of Direct Taxes stated that making online payments mandatory, a move announced in December, aimed at giving businesses time to install and operationalise online payments/electronic payments. As for the bigger picture, the Government hopes this move will promote a cashless economy in India. The Government also wants to promote the use of RuPay card among merchants in India.

But besides that, this is how moving to online payments can benefit your business –

According to a KPMG report, the number of merchants adopting digital payments in India increased to over 10 million in a short span of 2 years.

Incorporating online payments helps your business receive payments instantly, and it is guaranteed. All you need is to choose a trusted payment gateway with low transaction charges to facilitate these payments.

Using UPI and RuPay Card for Online Payments:

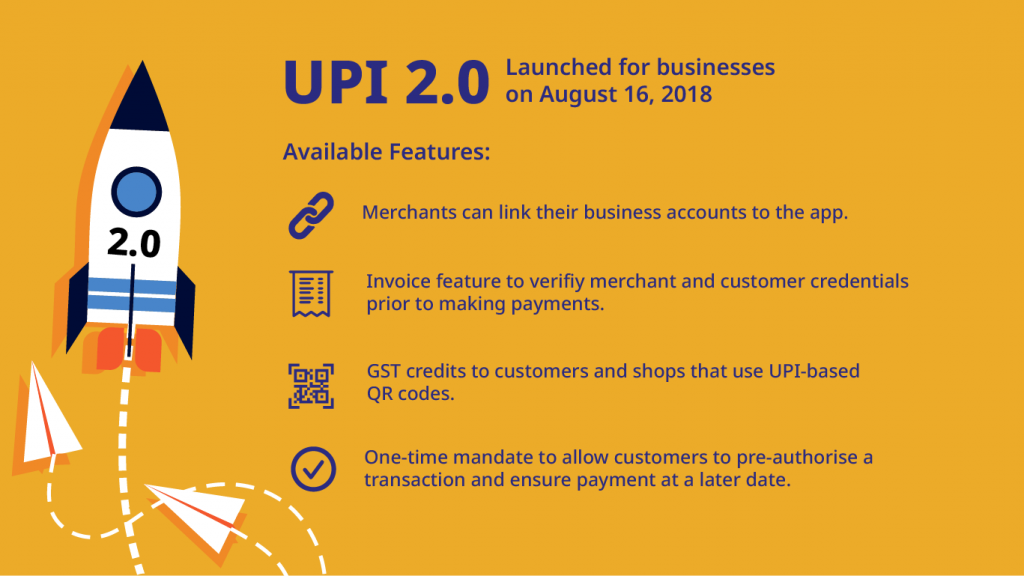

UPI:

The most popular mode of payment in 2019 was UPI. By the end of 2019, UPI crossed 10 billion transactions. December 2019 alone accounted for 12% of all transactions made on UPI.

Small businesses have adopted UPI (Unified Payments Interface) is faster than other modes of payments. There were 30 million UPI transactions just within a year of its launch!

If your business is looking to start facilitating electronic payments, go for a cheap payment mode like UPI.

RuPay:

RuPay – a combination of Rupee and Payment is an Indian version of credit/debit card. It is very similar to international cards such as Visa/Master.

RuPay has changed the way India sees digital transactions. More than 600 million people hold RuPay cards today. Plus, you can use RuPay for international payments too.

With RuPay Cards, you get:

Lowered processing fees: Transaction fees lesser than Visa and Mastercard, and you can also use the card across the globe!

Acceptability: These cards are accepted at over 1.45 lakh ATMs, 26.14 lakh POS terminals and e-commerce websites in India.

Safe & Secure: These cards are likely to be more secure as they come with EMV (Europay Mastercard Visa) chips. This reduces the risk of fraud drastically.

Instamojo – for fastest integration and easy online payment collection

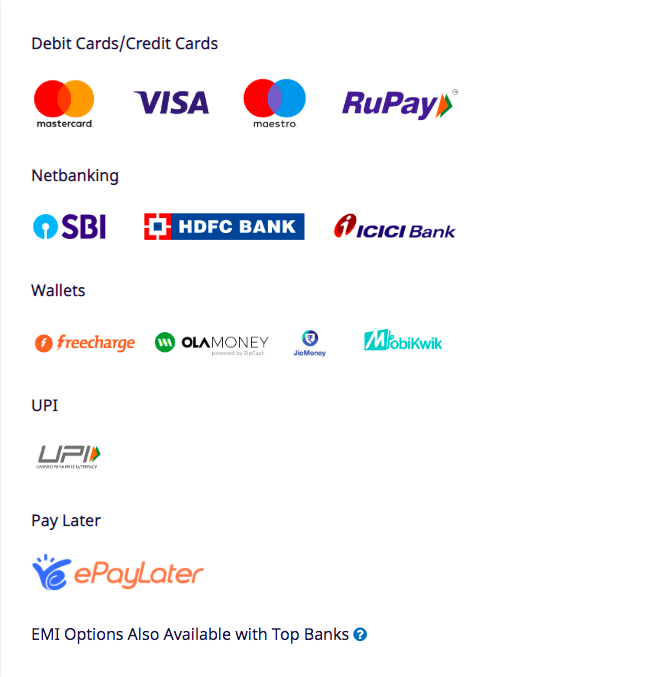

Instamojo facilitates UPI and RuPay payments for all businesses. Among these, Instamojo also allows all online payment modes, from e-wallets to debit/credit cards and more.

Take a look at all the options available at competitive prices for your business.

With Instamojo online payment gateway, you get:

- ZERO maintenance fee and ZERO setup costs

- Pay only on a successful transaction. No prior commitments or payments required.

- Get started instantly with online payments.

Security for online transactions:

Instamojo servers are encrypted by the 128 bit AES(Advanced Encryption Standard) Encryption. Instamojo is PCI-DSS compliant.

All Online Payment modes:

Instamojo enables all online payment modes for your business – net banking, UPI, debit/credit cards, digital wallets like Paytm and NEFT, RTGS and IMPS transactions too. This way, customers can pay using any mode they are comfortable with.

Faster Payouts:

Besides the default payout period, Instamojo offers faster payout options: Instant Payouts, Same Day Payouts and Next Day Payouts. For a varying additional fee on each payout, you can receive money faster into your bank account.

Convenience Fee:

Instamojo zero convenience fee allows you to charge customers an additional 2%+Rs.3 on a transaction, so you do not pay any fee. With this feature, you get exactly what you charge, in your bank account.

Pay Button:

You need not be a developer to know how Instamojo’s pay button works. If your travel website uses Pay buttons, you can create one on Instamojo. The Instamojo embed button allows you to simply copy/paste the HTML code to your site and add a pay button to collect payments easily.

1 comment

Some really tremendous work on behalf of the owner of this website, utterly great content.