Some good mid-week news! An RBI committee for MSMEs recommended doubling the cap on collateral free MSME loans. The committee suggested hiking the ceiling for the loans from INR 10 Lakh to INR 20 Lakh.

This comes in light of the Government seeking to change the definition of MSMEs in the country. The loan hike will be extended to MSMEs that avail the Mudra loan scheme too. The RBI and the Government are working together to improve credit and loan facilities for MSMEs in the country.

What are collateral free loans?

A collateral free MSME loan does not require the borrower to offer any asset or pledge collateral to borrow against. The loan given to your business is unsecured, and the lender doesn’t have any asset to fall back upon in case of default on part of the borrower. Small businesses avail collateral free loans in case of urgent funds. It is similar to a working capital loan. If your business has a good credit history, it is easy to apply for these loans.

Some quick to know features about collateral free MSME loans:

- The easy online application process

- Flexible tenure up to 5 years

- Easy loan payment options like Auto-debit / ECS / PDC.

- Quick processing and direct credit of funds

Why the increase in collateral free MSME loans?

The increase in loan limit for small businesses will prove beneficial for MSMEs that are expanding their growth. MSMEs contribute over 45% to the manufacturing sector’s output and 40% to the nation’s exports. However, the past three years saw a steady flow of challenges for the sector due to the following reasons:

- Non-availability of credit at reasonable interest rates.

- Reluctance from banks to provide extension on loans due to the risk factor. This leads to over 40% of MSMEs still relying on the informal sector for loans which leads to high rates of interest.

The RBI panel is looking to bring about a huge change in the MSME sector. Some of the already incorporated milestones include the restructuring of stressed loans unto INR 25 crore.

The Government too has initiated several loan schemes for the MSME sector. The introduction of the Mudra loan scheme by the Government has helped several micro companies looking for quick loans to run their business.

What is Mudra Loan? How do they help MSMEs?

The new RBI panel recommendation to increase collateral free MSME loans to INR 20 lakhs includes those MSMEs that wish to avail loans under the Mudra Loans scheme by the Government.

Launched in April 2015, The Pradhan Mantri Mudra Yojana (PMMY) is a loan scheme by the Government and designed for all micro-units in the non-agriculture sector.

Currently, any micro business involved in trading, manufacturing and servicing can seek loans up to Rs 10 lakhs under Mudra loans scheme. The Mudra loan scheme offers credit facilities to micro and small enterprises engaged in income generation.

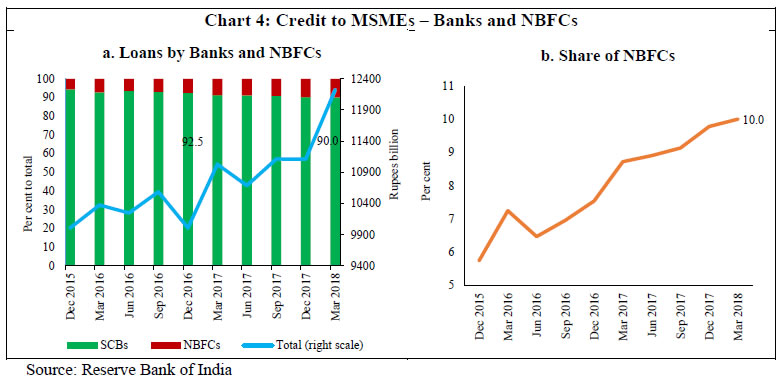

The loans are given by banks and non-banking financial companies as working capital and term loans for business enterprises in manufacturing, trading and services.

Quick tips on Mudra loans:

- Borrowers are not required to provide security or collateral.

- There are no processing charges on Mudra loans.

- The credit from Mudra loans can be used for term loans and overdraft facilities, or to apply for letters of credit and bank guarantees.

Mudra allows banks to refinance loans across three categories:

- Shishu- for loan amounts up to INR 50,000

- Kishore – for loan amounts of INR 50,000 – INR 5 lakh

- Tarun – for loans between INR 5 lakh-INR 10 lakh

Similar to loans like Mudra, if you are looking to avail loans for your business, you can apply with Instamojo. Simply create an account on Instamojo and apply for a loan in 3 easy steps.

1 comment

This is an awesome article, It helped me a lot about mudra loans.