The Government’s Atmanirbhar Bharat Abhiyan Scheme came into effect on May 12th, when Prime Minister Narendra Modi announced the scheme to the nation to support MSMEs affected by the COVID pandemic.

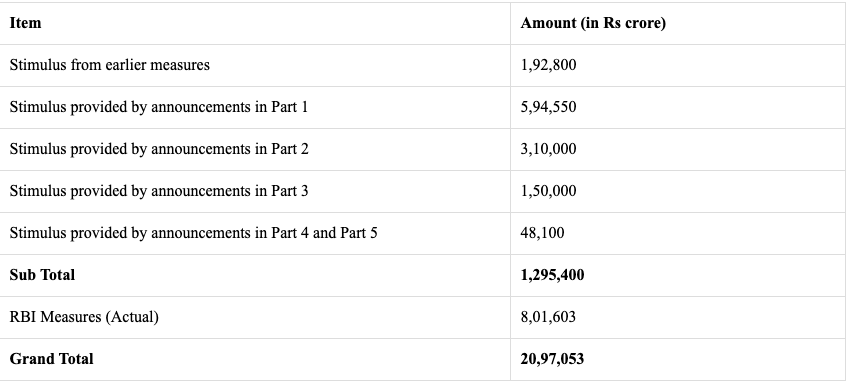

The Atmanirbhar Bharat Abhiyan Scheme primarily carries a ₹20 Lakh crore package which will be used to cover –

- Economy

- Infrastructure

- System

- Demography

- Demand

Top Features of the Atmanirbhar Bharat Abhiyan Scheme

Atmanirbhar, meaning self-reliant is moving towards making Indian MSMEs independent, through several credit schemes. In fact, just last week, The World Bank pledged over $750 million to the scheme, to help MSME sectors gain liquidity.

Collateral free loans for businesses

The core of the Atmanirbhar Abhiyan scheme is providing collateral-free loans to the MSME sector. According to this, small businesses can borrow up to 20% of their complete outstanding credit from approved banks.

If the small business has up to ₹25 crores outstanding or less than ₹100 crore turnover, then they are eligible for such loans. The scheme is valid until October 31, 2020.

Increase in borrowing limits

State Governments will increase borrowing limits for the MSME sector from 3% to 5%. This will give the MSMEs in the state extra resources of ₹ 4.28 lakh crore.

The move aims to boost the following:

- ‘One Nation One Ration card’

- Ease of Doing Business

- Electricity distribution and boosting urban local bodies revenue generation.

Credit boost to farmers

The Agriculture sector is perhaps the worst hit after the logistics sector. To help out, the Atmanibhar scheme has issued an agriculture package of ₹ 1.63 lakh crore, which includes direct farm produce access and fisheries, animal husbandries, and micro food enterprises.

Over 2.5 crore farmers stand to benefit from this scheme too. They will be provided institutional credit facilities at subsidised rates with ‘Kisan Credit Cards’.

Read: The Best Government Schemes for Farmers in 2020

Debt for MSMEs

A subordinate scheme for MSMEs which supports stressed businesses that have Non-Performing Assets (NPAs). This scheme will provide MSMEs with debt from banks which will be used as equity.

The Government will facilitate a whole of ₹ 20,000 crores as subordinate debt to the MSME sector.

The Government will allocate over ₹ 4,000 crores to the Credit Guarantee Fund Trust, which will provide partial credit guarantee to banks providing credit under the scheme.

Schemes for Street vendors

The Government is reaching out to street vendors and owners of Khirana stores as well.

The special initiative under the Atmanirbhar Abhiyan scheme will provide easy access to working capital of up to ₹ 10,000. The scheme is expected to generate liquidity of ₹ 5,000 crores.

How has the MSME Sector reacted to the scheme?

Is the Atmanirbhar Bharat Abhiyan Scheme actually helpful? An ET article stated that only 6% of businesses said they would avail benefits under the Government’s 20,000 crore debt provision for 2 lakh stressed MSMEs.

Small businesses are looking for quick cash and short term working capital benefits to bouncing back.

According to an article by The Wire, the Atmanirbhar Bharat Scheme will work for climate-resilient development in the country. For example: Providing amenities to battle drought, floods or the torrential cyclonic spells that can disrupt the gradual recovery of these businesses.

How has the Atmanirbhar scheme worked for your business? Let us know your thoughts in comments.