If you use digital payments in 2020, chances are you use UPI (United Payments Interface). But what do you do when there is a cash crunch and you need to pay your vendors? The public is speculating an option to avail credit on UPI.

2019 has been the biggest year for UPI payments in the country. This year, a statement by NPCI showed that Indians made a record 1.22 billion transactions using UPI, making it the preferred payment method.

Benefits of Credit on UPI:

What makes customers use UPI payment method? The ease, accessibility to transfer money in short, quick steps.

Imagine this, you go to a Kirana store and order 2 cups of chai. The amount is 20 rupees. Do you pay with your credit card or use UPI?

Currently, there is no option to avail credit using UPI since it is connected to funds available in the bank account.

Having a UPI-based credit availing system can help increase P2P and P2PM transactions irrespective of the amount of money in the account.

How else can this benefit your business?

- With UPI-based credit, you can pay your vendors any amount due without the hassle of signing a cheque or making a trip to the bank.

- Currently, the transaction limit on UPI is Rs. 1 lakh. With a UPI-based credit availing system, a business can take advantage of a credit limit that could be much higher or in addition to the existing limits on available funds.

- Businesses indulging in large payments to vendors can use credit on UPI to make these payments without the risk of losing (cash) or having it stuck in between transactions (online) that could take a toll on working capital.

With easy access to credit card and the quick operability of this payment mode, introducing credit on UPI will not only help increase the number of transactions but bridge the gap between both payment modes for customers.

Credit Card vs UPI – what do your customers prefer?

Did you know India made UPI transactions worth ₹.8.7 billion in 2018-19 as compared to the ₹.6.03 billion via credit cards?

There are multiple reasons why India prefers UPI to credit cards.

- Getting a UPI handle is not just easier, compliance and regulations are also low on this payment instrument. Getting a credit card includes having an appropriate credit score and many other risk mechanisms that a bank/lender considers.

- UPI is easier to operate. You just need to create your VPA and connect your bank account. In 2 steps, you transfer money to the other account.

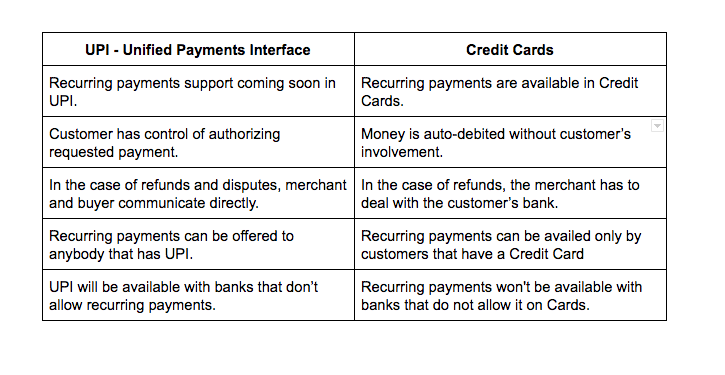

Another use for both credit cards and UPI are with recurring payments. Businesses that use recurring payments with their vendors want aUnited Payments Interface-enabled recurring payment system to be set up soon too.

It’s probably a good thing that you can use Instamojo to collect payments using UPI as well as credit cards. At Instamojo, We support various United Payments Interface modes. You can even add UPI payments to website or app in under two minutes. Simply create your Instamojo account, and start collecting payments.