GST for MSMEs just got a whole lot easier.

The GST council is all set to launch a new GST return filing system – which will benefit MSMEs and small businesses. How? The new system is set to be simplified, functional, easier and has more filing options.

This comes in the wake of many other GST compliance regulations for MSMEs such as:

- An increase in GST limit for MSMEs to INR 40 lakhs from the previous INR 20 lakhs.

- Providing GST benefits through increased use of UPI-based QR codes in stores.

What is GST Returns?

GST returns are a detailed report of the sales and purchases made along with tax collected or paid. GST return filing is generally done either on a quarterly or annual basis. Small business taxpayers (under general circumstances) furnish 3 monthly and one annual return.

Authorities will calculate tax liability based on the filed returns.

A registered small business has to file GST returns when:

- They purchase or sell products

- Input tax credit against GST paid on purchases

- Provide output GST on sales

Easier Compliance:

The introduction of the ‘upload-lock-pay’ facility last year – where invoices can be uploaded continuously by the seller and continuously viewed and locked by the buyer, led businesses to upload sales invoices in ANX-1 before the deadline.

MSMEs expect a friendly filing system that caters to the ease of doing business. Currently, small business taxpayers can file for GSTR -1 quarterly if their turnover is below INR 1.5 Cr. This limit has been raised to INR 5 Cr. which will benefit a major part of small businesses.

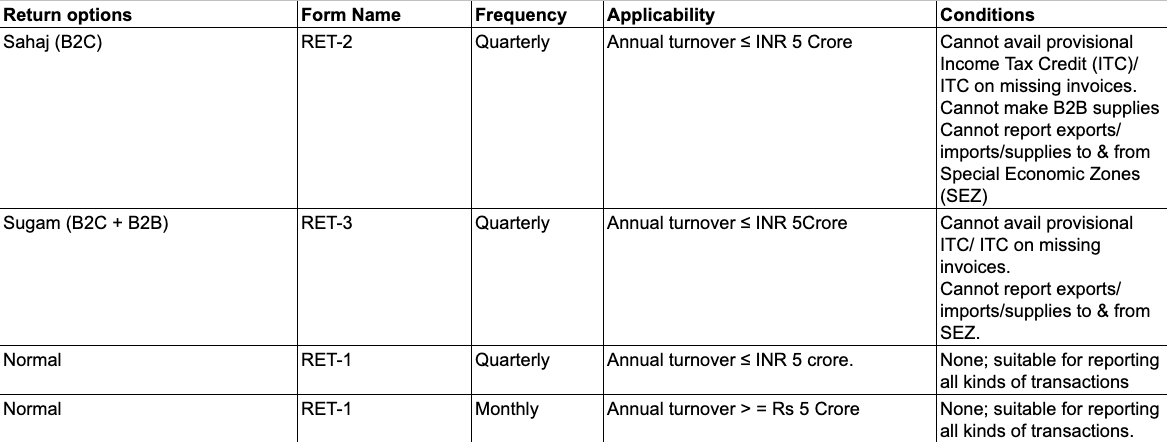

Small businesses taxpayers can choose either of the following four returns:

Ability to File Multiple Returns:

MSMEs and small businesses have options to file using any of the four above mentioned return forms. However, it could be daunting.

Creating multiple return options like above will allow small business to complete filing in less time and effort.

It enables the GSTN to sort taxpayers at the source and do better verification of filed returns.

Furthermore, there is an option to switch between three quarterly return types at the beginning of the quarter whereas once a year for those switching between monthly and quarterly returns.

Easier Payments:

MSMEs registered under the MSMED Act, 2006 – MSME Samadhaan, tend to choose quarterly filing of returns, which leads to a delay in the uploading of invoices.

The delay affects recipients ITC claims and will lead to a delay in payments to vendors.

Under the present system, the sales details are reported after the quarter is over, but the new system encourages uploading invoices at the convenience of the supplier with deadlines.

A generous amount of regular reconciliation can avoid any excess tax payment in cash.

In conclusion, the new GST return system sets up a foolproof system of reconciliation of details reported by vendors and buyers and hence aiding the technologically ill-informed taxpayers to plain sail through filing compliance.

Update: A recent article by the Financial Express stated that the GST Council will be revising measure to exempt small businesses having a turnover below INR 2 crores from filing for GST returns.

This move came in light of filing numbers falling despite increasing deadlines. Therefore, to reduce compliance burden, the council might increase the limit to INR 5 crores, which will exempt 70% traders from GST filing.

With the simplified processes, businesses must still upload their invoices for the financial year. Creating and managing invoices may seem like a daunting task. With Instamojo, you can create GST-friendly invoices using the Invoice Generator app!