The Trade Receivables Discounting System or TReDS is a 2018 initiative by the RBI. The platform could help small businesses now more than before.

In this blog, we will explore the different features of the TReDS platform that all MSMEs need to stay updated on. You will also find out how you can manage your working capital by registering on the platform.

What is TReDS?

MSMEs continue to face the issue of having unpaid invoices from vendors, and during COVID, that has only added to the pile of problems. The Trade Receivables Discounting System (TReDS) is an online platform to facilitate the discounting of bills and invoices of MSME suppliers.

The platform helps MSMEs get their payments faster. The platform also has a lower annual interest payout for SMEs.

The prime function of the TReDS is to enable discounting of invoices of MSME sellers that are raised against large corporates, which helps them manage working capital needs.

“ TReDS would facilitate the discounting of both invoices as well as bills of exchange.” – RBI spokesperson

Top features of TReDS

- Common platform linking MSME sellers, corporate buyers and banks

- Complete online transactions

- Competitive discount rates

- Seamless data flow and standardized practices ensured by the Government

How the TReDS platform helps manage working capital for MSMEs:

The TReDS platform On Aug 29, 2020, TReDs experts recommended MSMEs to consider accessing funds on the TReDS platform. The platform allows MSMEs to receive money upfront which helps them resolve any working capital problem and therefore helps manage their business better. The centre stated that discounting receivables can be a good source of finance for cash-deficient MSMEs since it is an off-balance sheet.

The TReDS platform allows small businesses to gain the working capital they need by auctioning their trade receivables.

A financier or bank bids a bill (trade receivable) from an MSME before its due date or before the buyer makes the payment.

” The TReDs platform is a good mechanism for MSMEs to fulfil their liquidity requirements.” – Sanjeev Chawla, Director, MSME-DI

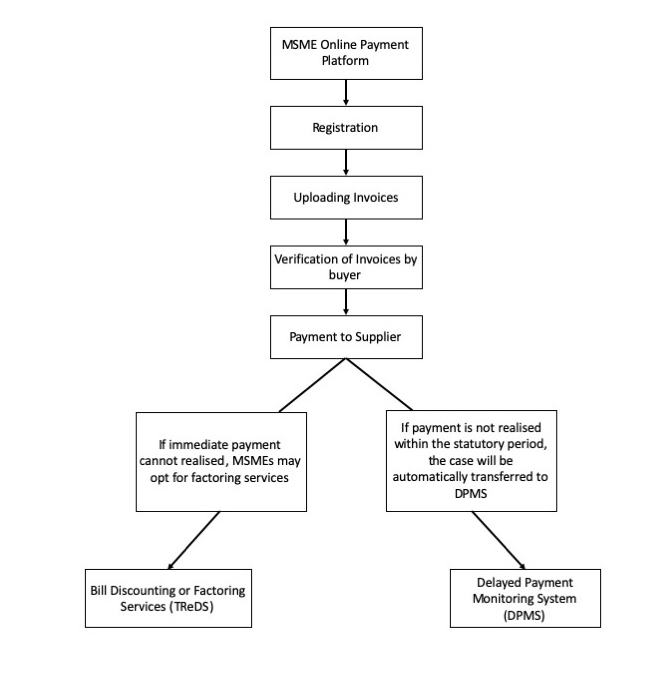

Registering on the TReDS platform –

Currently, around 10,000 MSMEs are registered on the platform. An increase in the number of TReDS registrations from MSMEs will help collectively improve liquidity for MSMEs.

How it works –

Banks and other financial bodies will bid to take over the receivable from the supplier (the MSME). The interest rate will reflect the creditworthiness of the large company on whom the invoice is raised, rather than that of the MSME.

The settlement file shows how much a financier has to pay an MSME seller and how much a buyer owes the financier on a particular date and time, ensuring credit discipline.

Also read: Register your MSME now on the Udyam Registration Portal

Why small businesses need to register

Even now, factoring (supplier bearing the interest) has not gone forward in India, because large companies continue to use their monopoly over small businesses and hence, delay payment for months.

Therefore, registering ensures there is no delay in payments and no bullying from larger corporations.

What’s the best way to maintain your working capital?

One of the best ways to ensure the Government pays attention to your working capital needs; register your business! You can register it on the new Udyam portal or on TReDS for free! Over 6.3 million MSMEs are still unregistered and are

Besides that, you need to also make sure that there is always cash flow reserves maintained in your bank account. Here are a few FREE resources that will help you maintain working capital in your business:

#1 – Watch our LIVE with Mr Ranganath Iyengar, a Chartered Accountant and Financial expert on how to manage your working capital

mojoSeries part XIV: How small business can manage working capital

We are LIVE for our 14th mojoSeries: How to manage Working Capital for small businessesJoin us in conversation with Ranganath Iyengar to know about maintaining positive cash flow, understanding cash flow needs for your business and more! We will be giving away a free ebook at the end of the webinar. Leave us your email id here: http://bit.ly/32XRQ0p

Instamojo यांनी वर पोस्ट केले गुरुवार, ३१ ऑक्टोबर, २०१९

#2 – Here’s a free ebook, complete with tools, tips and links to help you manage your cash flow and find the support you need to run your business.

Let us know how we can help your business.