Mobile wallets vs payment banks – this is the big debate today! What is the best way to approach digital payments in India for small business owners? While mobile wallets and payment banks have a few things in common, they are very different from one another. Let’s find out.

Contents

Mobile Wallets vs Payment Banks

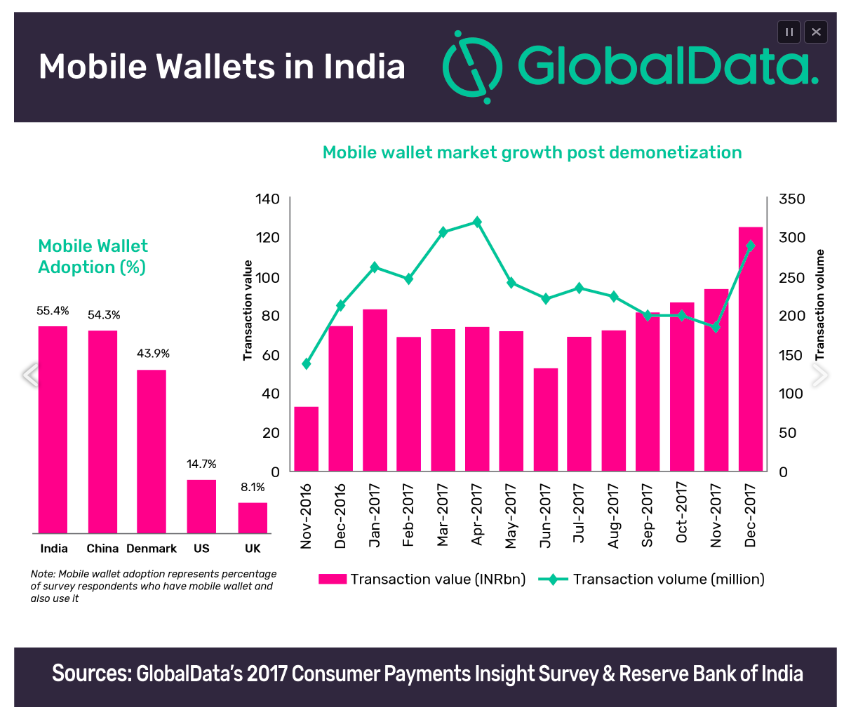

To give you some context about Mobile wallets and it’s usage in India, here’s a graph from analytics giant GlobalData.

Payment Banks – New in town

Wallets are quickly replacing cash. However, Payment banks are relatively new and have come into the ecosystem only recently. According to experts, the impact could be huge in the rural area.

Payment banks were called the next big thing in the fintech industry largely because of the simplicity in the model and it’s potential geographical inclusivity.

India has the most mobile users, yet 40% of India still does not have a bank account.

Payment banks were introduced last year to get more rural areas into the banking sector. More recently, the government also announced the launch of India Post Payments Banks that will become operational by August 21, 2018.

What are Digital Wallets?

Digital wallets store your cash digitally and enable mobile transactions. You can add money to your wallets through cards, net banking, and UPI. Earlier, you could only transfer money to and fro the same wallet. Now, with UPI and RBI’s interoperability rules, you can send money directly to anyone’s wallet or bank account.

Some of the advantages of wallets

- Allows you to store money digitally, without the need for carrying physical cash.

- Most digital wallets also have inbuilt platforms to enable recharges and bill payments.

- Allow for multiple cashback offers and discounts while processing transactions.

- Wallets are an ideal option for individuals who want to process payments without always putting in their bank details.

Some of the disadvantages of wallets:

- Wallets do not offer any ATM or card facility.

- Wallets do not offer any interest dates on unused money in the wallet.

- Do not offer any cards or cheque books.

- Have limited features as compared to a payment bank.

What are Payment Banks?

Payment Banks is a new model introduced by the RBI. They work as the middlemen between the digital wallet and the traditional bank.

Advantages of payment banks

- They offer interest on unused money.

- Offer various features such as fund transfers and withdrawal via ATMs, unlike wallets.

- Users can store up to Rs. 1 Lakh and may be increased in the days to come.

- Users can use net banking, UPI, and internet banking as modes of transactions.

Disadvantages of payment banks

- Offer debit cards and cheque books but no credit cards.

- These cards can be used in any ATM for transactions.

- Do not offer any credit or loan facility to their customers (but they can offer these via third-party tie-ups).

Mobile Wallets or Payment Banks?

Your business requires a reliable mode of payment. The best way to choose the right payment mode for your business is to understand which payment mode will suit your business model. You may like these 7 simple tips to choose the right payment mode.

Why worry about choosing one mode when you can offer your customers all modes of payment? Instamojo allows you to let your customers pay with Debit, Credit Cards, Netbanking, Wallets, UPI and even NEFT – all in just one payment link. Centralise your payments in one link!

3 comments

Even in developing countries like Nepal, the hype of digital wallets are growing and development of more of such wallets being used by millions of Nepalese says it all. All these wallets have been created with authority and security so people are fearlessly using it in their daily lives. It has eased the life of people as they do not need to stay in queue or visit physical counter for basic utility bill payments or movie/flight ticketing. Life has been much simplified with digital wallets like IME Pay in Nepal which is one of the most trusted digital wallet of Nepal.

Nowadays, peoples are using payment banks more than mobile wallets.

Informative blog! Thanks for sharing it.