Interesting news! The IT ministry has introduced new and improved BHIM 2.0 features for small businesses!

BHIM 2.0 is the NPCI brainchild of online payments. It is one of the most popular payment modes since its inception in 2016.

The new features of BHIM (Bharat Interface for money) 2.0 include increasing the current transaction limit for high-value payments. These new features come as a move to make BHIM 2.0 more business-friendly.

What are the new BHIM 2.0 Features for small businesses?

According to an official release by the IT ministry, here are the new features for small businesses:

- Increased transaction limits for high-value transactions

- Linking multiple bank accounts

- Additional Languages – Konkani, Bhojpuri and Haryanvi (currently, there are over 13 languages on the BHIM 2.0 app)

- Make donations using your UPI ID

- The option of using UPI ID as a payment option while subscribing for IPO

- Gifting money to peers

Launch of BHIM 2.0 by Hon’ble IT Minister, which is integrated with new features such as increased transaction limit, Donation gateway, merchants offers, linking of multiple accounts and linguistics diversity in 16 languages.@NPCI_NPCI @NPCI_BHIM @dilipasbe #BHIMUPI pic.twitter.com/oHa6IqVNOI

— Ministry of E & IT (@GoI_MeitY) October 22, 2019

Why small businesses use BHIM 2.0 –

Over the past 1 year, UPI recorded a record-breaking 500 million payments made on the app. BHIM 2.0 launched in 2016 and saw over 10 million downloads in 10 days.

The BHIM 2.0 UPI app is easy and safe to use for payments. All you need to do is download the BHIM app, link it to your mobile number and instantly send and receive money from your bank account.

- The payer doesn’t need the recipient’s account number to make the payment.

- The payer doesn’t need to load money into the BHIM app; they can directly transfer the funds from their account.

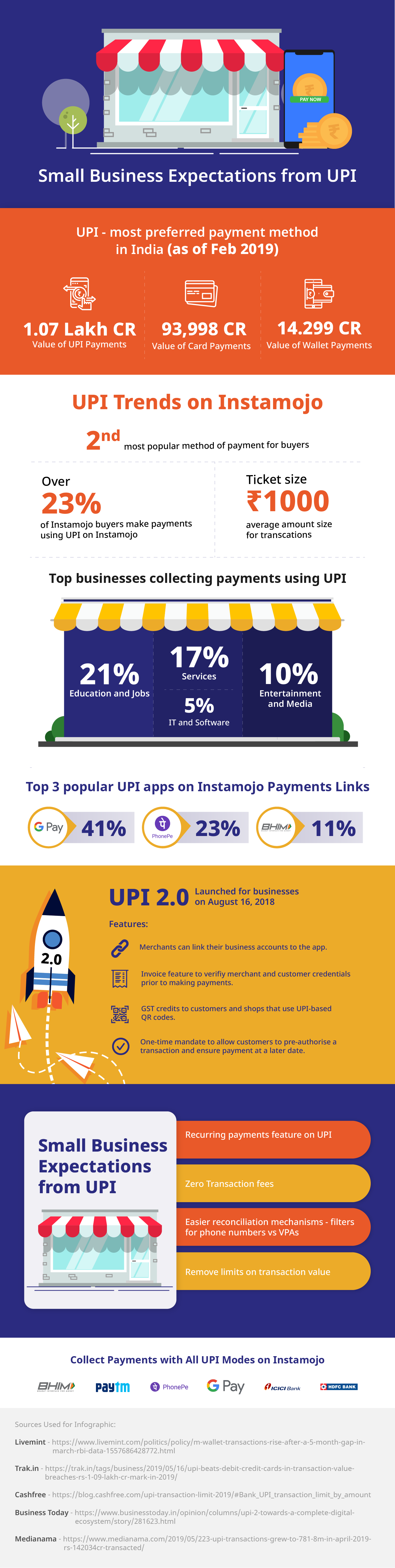

What are small businesses expectations from UPI?

A recent update by the Government shows that UPI transactions have crossed 1 billion in October 2019!

UPI crossed 100 million users too – making it the fastest payments adopted anywhere in the world. This development led the Government to take the payment system global! Soon, UPI will kickstart operations in UAE and Singapore.

UPI transactions are expected to account for over 50% of Digital transactions in India by 2023. Small businesses use UPI more than any other modes of payment. Within 1 year since its launch, UPI recorded 30 million transactions from small businesses.

But what do small businesses want from the revamped UPI (United Payments Interface)? We created an interesting infographic explaining small business expectations from UPI.

At Instamojo, we support various UPI modes, including the BHIM app. You can also add UPI payments to your website or app in under two minutes. Simply create your Instamojo account in 2 minutes and start collecting payments online.