Are you a newbie entrepreneur or an established business owner looking to pick a payment gateway for your business?

With so many options available in the market, it can be a difficult task to pick the best gateway for your business. It can get worse because payment gateways in India come with a wide range of jargon and industry-related terminologies.

Here is a glossary of words you, as a business owner, should know. This will not only help you pick the right payment gateway or partner but also help you understand the nitty-gritty of how payment gateways work.

Let’s Dig Right into Payment Gateway Terminologies:

Merchant

Someone who sells products or services. They are mainly businesses which may be small or big.

MID

Short for merchant ID. It is a unique 16-digit number provided to the seller by the payment gateway.

Order

Orders are a potential sale. A completed order becomes a sale only after the payment is successful.

Interchange Network

An Interchange network is a card network that facilitates different card payments from different banks. Example: Visa, MasterCard, Rupay etc.

Annual Maintenance Cost (AMC)

An Annual Maintenance Cost is what payment gateways charge as their annual fee. It typically ranges between Rs. 1,200 – Rs. 10,000.

Authentication

Authentication is the first set of checks by a bank to validate the identity of the person making the payment. Your PIN, OTP, CVV no., card number, 3D Secure number, biometrics – retina scans/fingerprints etc are authentication parameters

Authorization

Once the payment is authenticated, it is sent to the customer’s bank via the interchange network to check: If the user making a payment has sufficient balance in their account. If the transaction initiated meets the issuing bank/buyer’s bank policies.

Acquiring Bank

An acquiring bank is a bank which allows you to make transactions through the payment gateway you choose.

Issuing Bank

An issuing bank is a bank the customer uses when making a transaction.

Nodal Account

A nodal account is created by an e-commerce company, payment gateway, wallet or payment aggregator. This is made specifically to accept digital payments.

Merchant Account

A merchant account is a temporary account created by the payment gateway to allow for transactions from the nodal account to the merchant account.

Capture

Once you have authorized payment, the money will be debited from your account and credited to the nodal account. For the merchant to receive the payment, they need to acknowledge that the money belongs to them. This process is called “capture”. If the particular merchant doesn’t raise a “capture”, the amount will be refunded to the customer’s account.

Settlement

Once a particular transaction has been “captured”, the payment gateway involved needs to “settle” the said amount with the merchant. The nodal account is different from your bank account.

A settlement happens when money is credited from the payment gateway’s nodal account to your bank account. This usually happens within 1-2 days or the payment gateway’s settlement cycles.

Refunds

If a customer is unhappy with your product, they can either opt for an exchange or initiate a refund. A refund is a reversal of a transaction. Some of the reasons for refund initiations could be customer dissatisfaction, delivery of defected products and more.

Chargeback

This happens when the customer isn’t aware of the transaction or disputes a transaction. This can be a failed or unsuccessful transaction or just a fraudulent transaction. Once he pulls up this complaint, the issuing bank puts this complaint under the “chargeback” category.

Once done, the onus to prove the validity of the transactions is on the merchant. If not done within 15 days, the merchant has to refund or pay the customer back for that transaction.

Note: Refunds and chargebacks, are not the same. A refund is initiated either from the side of the consumer or the merchant, to reimburse the consumer as they are dissatisfied with your goods or services. A chargeback is where a customer is asking the issuing bank to forcefully remove the money from the merchant account, as the transaction is not initiated from his side.

Chargebacks are harmful to your business reputation! Here are a few ways you can avoid a chargeback.

Bank Charges

The acquiring bank deducts this amount for offering card payment services to you. This deduction rate is as per the specifications provided by the RBI.

Processing Charges

Processing charges as the name implies, are levied by the payment aggregator for processing your transaction. Additionally, the aggregator may also need to pay a set amount to the other parties involved in processing the transaction. These charges are only levied for successful transactions.

Transaction Discount Rate (TDR)/ Merchant Discount Rate (MDR)

TDR is the amount that the payment gateway charges the merchant for transacting with them. The merchant receives his money with the TDR deducted, after a successful transaction. These charges will be specified by the payment gateway, as part of their pricing.

TDR = Bank Charges + Processing Charges + Taxes

There are many more terminologies in the world of payments. These basic ones can help you get a better understanding of the various offerings a gateway has to offer you.

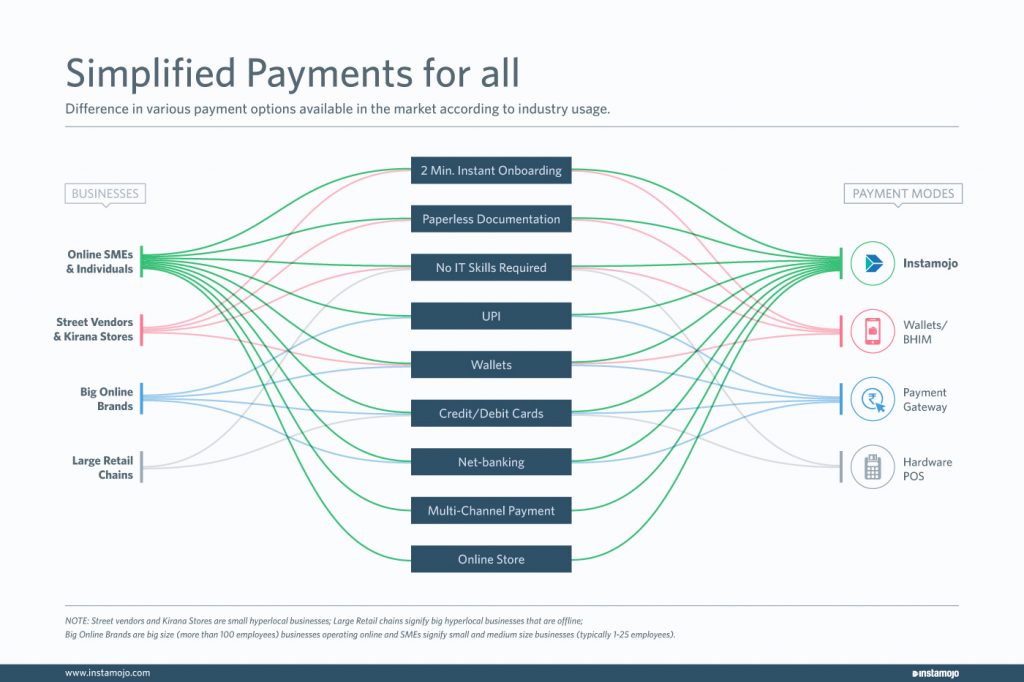

Still, need help figuring out the best payment method for your business? Check this flowchart out:

With Instamojo, you can do more than just collect payments.

You can use a host of our offerings to help your online business grow and scale. Some of our free services are our free online store, invoice generator, SMS alerts, pro analytics and more.

We try our best to help you understand the various processes involved in the functioning of our gateway. Additionally, you can also check out our Youtube channel for tutorials, product updates and more.

5 comments

Thanks for the information i am shop machine manufacturer can i opt your gateway

Thanks for the information, I am a machine manufacturer can i use your gateway and please provide the details for taking gateway.

The amazing post helps us to reduce the pressure of collecting payment from our clients.

Thanks really a great informative post. Keep sharing like this post.

Thanks for the information I am a food manufacturer what kind of licence i required to take your gateway services