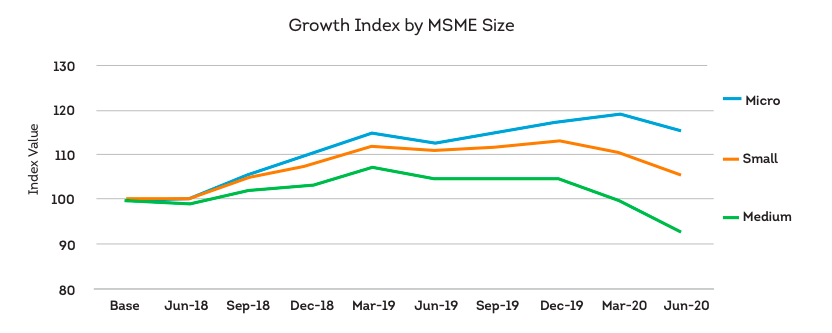

Over the last 2 years, micro-businesses from the MSME sector have seen the maximum growth – even in the face of a pandemic.

How did that happen? It’s probably because of digital lending innovation. Also, India has over 6.3 crore MSMEs out of which 6.30 crore, 99.4% are micro-enterprises.

A report by Transunion CIBIL and Ministry of Statistics and Programme implementation states that micro-enterprises utilised the facilities provided by microloans to propel growth.

Factors used to analyse growth for micro-businesses –

- Increase in exposure value

- Increase/decrease in the credit risk of non-performing assets

- Increase in collection efforts by lenders

3 ways digital lending helped micro-businesses survive – and grow

A new definition for MSME size

While medium-sized enterprises have adhered to a traditional form of lending (private banks, larger loans), micro-businesses have stuck by microloans.

The revised definition of MSMEs could play a role too. For example, micro-units are any business with investments up to Rs. 1 crore and turnover of fewer than 5 crores. This allows them to borrow less, in smaller amounts and payback at lower interest rates.

Businesses took a hit mainly with cash flow. Microloans take care of that problem with quick, easy to repay incentives.

Also read: MSMEs get new definition in India – based on investment

Increased business in tier 2 cities

According to OkCredit, micro retailers are switching to online digital solutions, from e-commerce to digital khata books. Since 2020, 16 out of 36 states bounced back to business levels higher than pre-pandemic times.

How? Complete digitisation of business. Tamil Nadu, Uttar Pradesh and Maharashtra show maximum growth in micro-businesses from tier – 2 towns. The states have also sanctioned the maximum amount of loans for MSMEs ( particularly micro).

Increased digital lending by NBFCs

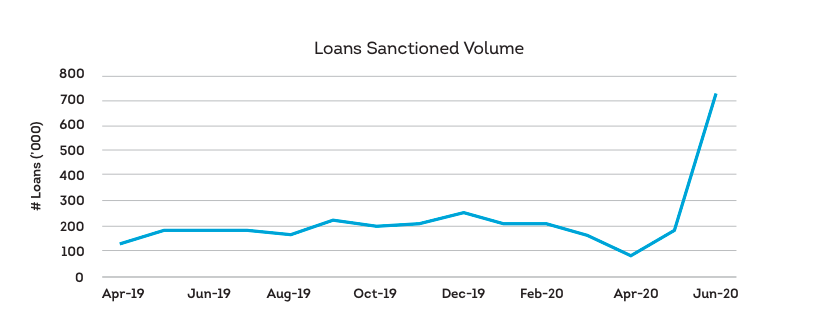

The impact of the Emergency credit line guarantee scheme has shown how quickly micro-businesses are bouncing back.

Increased lending by NBFCs and Public Sector banks have increased over the past year. The study by Transunion CIBIL shows that micro-businesses are the largest beneficiaries of the ECLGS scheme.

Scared to borrow loans? Take a course on finding funds

Is your business funding ready? What are the documents you need to compile a funding report? What funding schemes can you take advantage of as a small business?

mojoVersity partnered with deAsra to bring you a free online course on finding funds for your business. Your business could be micro, small or medium but a smart lending decision matters irrespective of business size.

1 comment

Thanks for the information that is really useful for me.