Recently, we launched our second edition of the Indian MSME Impact Report. Our core findings showed that over 75% MSMEs in India agreed that technology is a necessity to solve daily challenges – such as payments, production of goods/services and reaching out to customers.

After a detailed six month analysis of the sector, the report highlights 4 similar concerns for MSMEs in India:

- Defining an MSME persona

- Challenges faced in the current digital environment

- Value perception of Fin-tech firms

- Business transformation

MSMEs in India currently contributes to over 29% of the country’s GDP. There are over 63.4 million MSMEs spread across India in 2019.

Key Highlights of the MSME Impact Report:

“The MSME sector makes up for a large chunk of the Indian economy, employing more than 117 million people and contributing to making India a $5 trillion economy. However, the sector still faces several roadblocks, like the lack of tech knowledge or the absence of a skilled workforce. We, at Instamojo, have always worked towards empowering Indian MSMEs through various digital solutions, addressing the gaps in their growth story.

“Through our report, we envision to be the voice of the MSMEs by bringing to the forefront facts that will open further channels toward development” – Sampad Swain, Co-Founder & CEO, Instamojo.

Re-defining MSMEs in India:

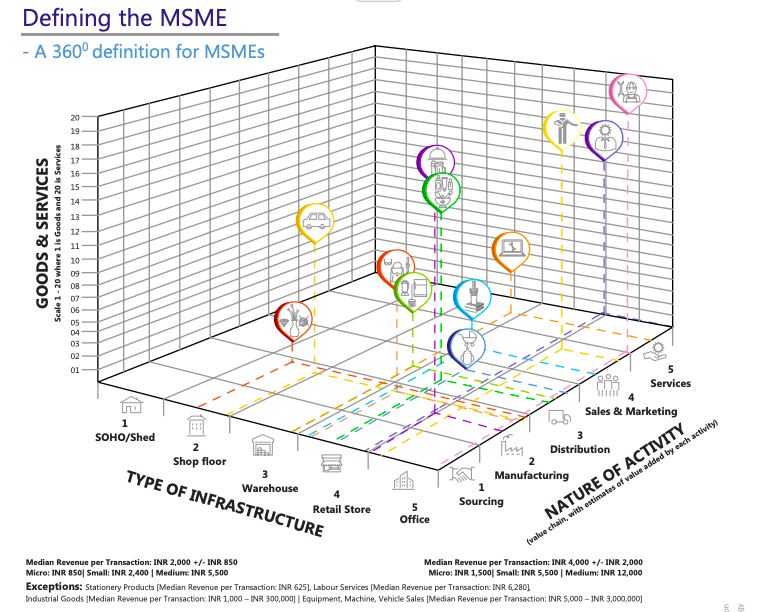

The report’s primary highlights include a unique re-definition of MSMEs in India. While the Government focuses on a definition based on annual turnover, the report defines MSMEs with a persona map, based on:

- ‘Goods vs Services classification’

- Meta categorization of business categories

- Type of infrastructure invested in

- Nature of activity within the industry chain

The report took a 360-degree definition of MSMEs and used a step-by-step method to analyse MSME definitions. You can get the full, detailed MSME persona analysis here.

Mapping the Journey of Indian MSMEs:

Other key highlights include a shift in MSMEs adaptation to technology in the post-demonetization and GST era. Over 75% of MSMEs believe that technology helps solve major challenges pertaining to operations. The challenges faced by the other 25% mainly include:

- Lack of skilled labour

- Little or no knowledge of technology.

After the implementation of GST, an estimated 9.2 million MSMEs registered under GST – a 50% increase compared to the previous tax regime.

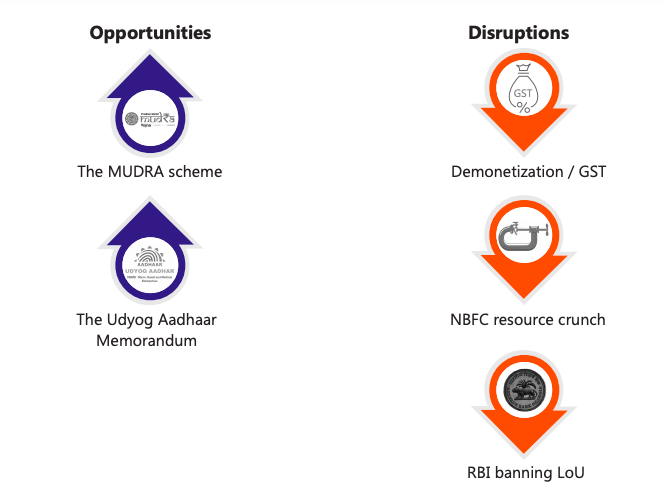

The MSME landscape has witnessed a paradigm shift in recent times, thanks to a mixed bag of opportunities and disruptions.

The Government’s MUDRA scheme: – allowed start-ups and small businesses to access capital ranging from INR 50,000 to INR 1 million.

The Udyog Aadhaar Memorandum: – enabled 5.2 million businesses to register officially and avail benefits which included exemptions on taxes, reduction in fee for filing patents, credit guarantee schemes and a concession in electricity bills.

Challenges MSMEs still face with digital payments:

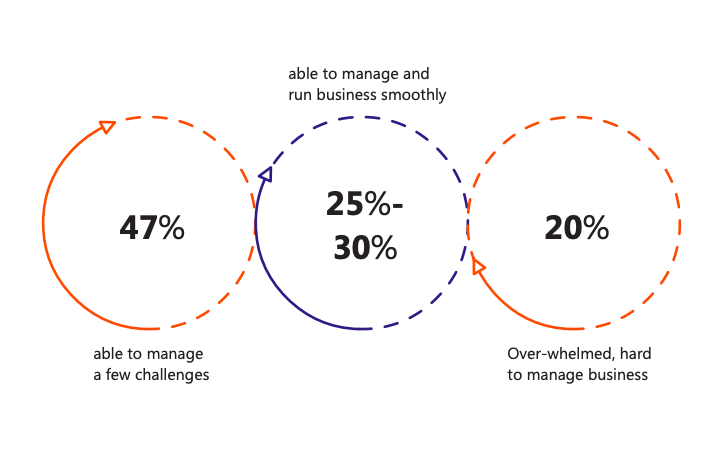

About 47% of the MSMEs(those who make use of digital payment solutions were surveyed) are only able to manage a few of the critical challenges, and 20% are overwhelmed by the hard-to-manage challenges.

The report also explains the majority ranking of payment gateway links by MSMEs. Over 56% Several MSMEs consider payment gateways to be the most trusted channel. The remaining 44% still prefer traditional sources of lending versus online peer-to-peer platforms like Instamojo.

Although demonetization provided a much-needed push to the digitization of payments in India, the demand for cash is still high. The total cash withdrawal record is INR 33 trillion in FY 2018-19, compared to INR 23.6 trillion in FY 2016-17 – a surge of 40.27%.

There is a high probability that MSMEs will adopt business analytics tools given that 47% of them have adopted digital tools for business processes, payments, and online sales in India.

The findings also suggest that:

- 35% of MSMEs shifted to digital payments due to ease of transaction

- 9% used online platforms for the availability of data synchronization and privacy features

- 11% opted for it due to customer preference.

Instamojo’s role in powering MSMEs in India:

The report also provided a detailed insight into the product offerings by Instamojo for the MSME sector – our primary user base! The study shows how Instamojo distinguishes its definition and product offerings to our 1 million strong merchants.

It also took a survey of customers perception of the products we offer, from our online store to our payment links. You can also read about an in-depth case study on the business impact of Legalwiz.in – a longtime Instamojo user and small business thriving in the digital era of online payments.

1 comment

What an exquisite article! Your post is very helpful right now. Thank you for sharing this informative one.