There are more than 20 million SMEs in India. As an online business, just having a store or website isn’t enough. Giving your customers the choice to pay via different modes is crucial too. There are many payment gateways in India. How do you know which is the best payment gateway for your business?

Let’s drill down and help you decide which payment gateway or mode should you choose for your small business:

Contents

MSMEs and Individual sellers

Do you own a business? What is the scale of your business depending on your investments and number of people you employ? If your answer falls below 50 employees and less than 10 crore of investment, here is what you should be looking for in a payment gateway for going online:

What matters?

Since you are a micro/small/medium business, it is of utmost importance to you that you get a payment solution that is –

- Cost friendly.

- Hassle free with documentation and legal matters.

- Convenient for your customers to pay online.

- Saves time on setup and maintenance of your online payment solution.

- Does not require knowledge of coding so that you do not have to hire a person to look into the online payments.

- Gives you an option for collecting payments from all existing payment modes like Credit/Debit Cards, Netbanking, UPI, EMI, Wallets etc.

- Lets you collect payments from multiple channels like Whatsapp, Facebook, Twitter, Pinterest, Instagram, etc.

- If you are an individual seller, it is important for you to showcase your products or services you are selling in an online store layout.

Small Hyperlocal Businesses

Do you own a Kirana Store or are you a vendor who is looking to collect digital payments online/offline (at the physical store)?

Your physical store might be doing well and you wouldn’t want to think about collecting payments online but think again. What do you do when a customer asks you to pay via cards? Will you be able to increase your sales if you offer your services online?

What Matters?

- Letting your customers pay via digital wallets will be an add-on for you.

- Look for a payment solution or provider that enables you to accept payments via not only just wallets but also various methods like Netbanking, Credit/Debit Cards, etc. Opting only for a wallet might look easy but it has a lot of hidden disadvantages that we will talk about in our next post.

- It also matters how easy and hassle-free your KYC (documentation) process is. You don’t want to go back and forth to your payment provider for getting your documents cleared and invest time and money.

- You will not want to hire an extra employee for looking after your payment provider. Your payment provider should be easy to understand for a layman like you and should not require advanced technical knowledge.

Online Brands

Are you in a business that sells online as a brand and employs more than 50 employees?

What matters?

It makes sense for you that you go with traditional payment gateways. Traditional payment gateways in India might take you longer to sign up with along with proper documentation verification but considering your investments are high, you should hire a dedicated person looking after your payment gateway integrations. Consider having all the payment options integrated with your brand website and let your customers pay you by any payment mode they are comfortable with.

How to choose a payment gateway

While selecting a payment gateway, these are the questions that you should ask yourself:

1. Integration :

What platform is your e-commerce website based on? Your payment gateway should be able to integrate with your platform.

2. On Site or Off-Site:

Do you want to send your customers to another website where they proceed with the payment or do you want an iframe pop up right there on your website so that your customer does not have to leave your website.

3. Set up Fees:

How much does your payment gateway charge you to set up your account? You should compare the setup fees because it can be a pain for start-ups in the beginning.

4. Pricing:

Check on the fees your payment gateway charges per transaction. You wouldn’t want to lose a large chunk of your profits in transaction fees.

5. KYC and Paperwork:

Check on the process of how your payment gateway checks on KYC documents and legal paperworks. It shouldn’t take too long and a cumbersome process.

6. Mode of payment:

What does your customer want: Netbanking, credit card, debit card options. Most of the payment gateways will provide these basic options but you should check on their transaction success rate. You don’t want to lose customers because of transaction failures.

7. Payouts:

How regularly does your payment gateway send your money to your account? It matters because you don’t want to run out of funds if the payout time is too long.

8. Security:

Your payment gateway should comply with Bank grade security level, like PCI DSS and provide a secure encrypted environment for payments.

Here is a list of the best payment gateways in India.

Large Retail Chains

Do you own a supermart or a large retail chain?

What matters?

Maybe selling online is not your thing. But adding more payment methods for your customers to pay with is a smart idea. You are looking for a solution that enables you to collect money as fast as possible at the cash counter. Do not look complex solutions that delay the payment processes. Traditional POS machines solves the purpose but having more options like wallets and Netbanking will help improve the payment experience for your customers.

You can also consider collecting payments with your own QR code and/or BharatQR.

Payment Solutions for All types of Businesses in India:

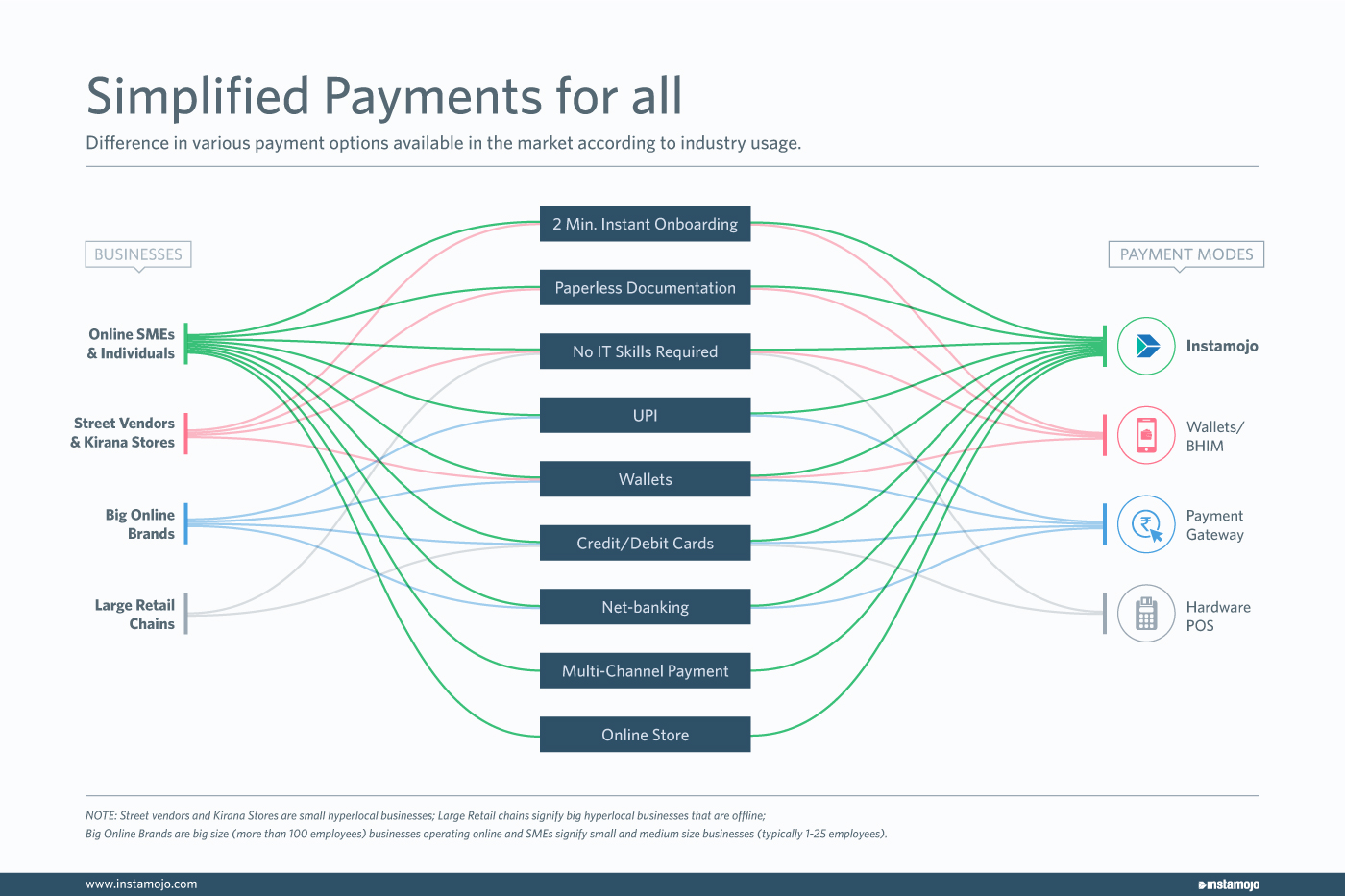

According to the business type, you can trace the graph and see your solution:

Hope this helps you decide on the right payment solution for your business. Choose wisely. It’s about money.

9 comments

Hi

Nice explanation about PayPal Payment System and very nice to describe step by step all points. we are visiting your blog many times and I find such useful information thank you for sharing us such a nice blog

Nice post. Your customers to another website where they proceed with the payment or do you want an iframe pop up right there on your website so that your customer does not have to leave your website. Thanks!!

Hi

amazing post I appreciate your post thanks for sharing this useful information the Payment Gateway is a processor place on your website a part of visitor workflow on your website where a transaction can be made. I think everyone wants to start who have the caliber.

Thanks for sharing helpful information about Online Payment Solution for more information about Online Payment then visit this site.

I like this article, It may be helpful for others.

Nice collection.

Exactly what I need…

Hey, Alka! It was a very interesting and informative read. To sustain in this highly competitive eCommerce industry I think e-store owners must consider integrating payment gateways in their website. I found a post which extols why it is critical for eCommerce businesses to have a payment gateway solution.

Its the best blog for me because i am searching for the best payment gateway in India as per the business site and type. Thanks again sir providing us valuable information.