Everybody wants to save money. But as a citizen of a nation, paying taxes also comes as a duty. A duty that is fast approaching as the financial year comes to an end this March.

While we aren’t here to tell you “don’t pay taxes” or “it’s a waste of money”, we do want to help you save whatever you can within legal limits.

For this, you should be aware of deductions and exemptions that help you reduce the tax you pay! Because every penny you save can be put into your growing business!

So here are some tax-saving hacks that every entrepreneur or small business owner in India should know!

Tax saving tips for small business owners in India

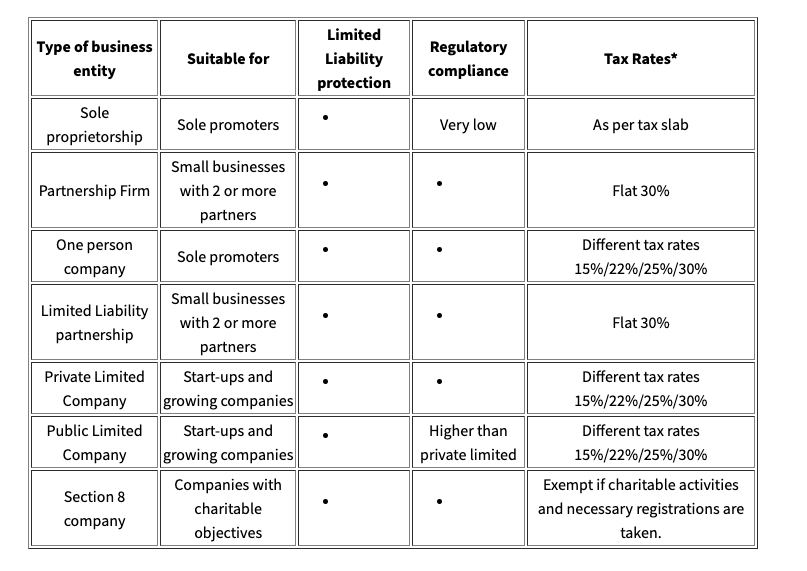

1. Select the right legal structure

When launching a new business you need to define your business structure. This will impact compliance, tax efficiency and operational matters. The simplest classification can be done based on ownership or based on the residence of owners.

Here is a breakdown of the different classifications and their tax implications!

Related read: 8 small business laws in India every business owner should know

2. Understand all kinds of tax deductions under the Income Tax Act

Section 80C of the Income Tax Act allows small business owners to claim deductions for investments made in specified assets such as:

- Life insurance premium

- Medical insurance premium

- Public Provident Fund (PPF)

- National Savings Certificates (NSC)

- Fixed deposits with a tenure of 5 years or more

The maximum deduction limit under this section is ₹1.5 lakhs per financial year.

Do remember these deductions will be applicable only if your startup is your sole job and not a part-time job.

3. Keep track of all expenses

Even if they seem tiny, if you have a record of them, you can avail of tax benefits later. Many expenses may seem mundane but later may count as a business expense.

It also cultivates a good habit in you and you are more aware of what your cash inflows and outflows are! It helps you understand your profit margin and also lets you build a healthy emergency fund.

4. Make home-based business claims

If you are a small business operating from home, this counts as an operating cost. So any expenses related to your “home office” like rent, utility bills, property tax and mortgage can be used to claim a deduction.

For online businesses, this tax-saving tip can save you thousands! You need to dedicate one room in your house to your work. Set up an internet connection and an ergonomic table and chair, and you’re done!

All you need to do to grow your business is be on www.instamojo.com and manage all your operations online.

Read other benefits of having an eCommerce website for your business here.

5. Employ family members

You can hire family members who don’t have any other income sources.

Your company can pay them even ₹2.5 lakhs per year (with the current tax slab) without any tax outgo for this relative.

Being able to hire family members is one of the biggest advantages of starting an eCommerce business at home.

Learn the basics of GST with our free digital course on mojoVersity: India’s simplest e-learning platform for small business owners

6. Avail input tax credits

If you are paying GST then there are opportunities for you to avail Input Tax Credit. This is the GST that you pay when purchasing goods or services for your business growth.

But you can only avail this if you treat these expenses as capital expenses and not business expenses in your account books. You cannot include depreciation costs either.

Know more about how to be eligible for ITC here.

7. Take benefits of the depreciation cuts

According to section 35AD of the Indian Income Tax Act, if you have a manufacturing business like a clothing business, you can claim 15% in depreciation.

If you buy new machinery that helps you with your business, you can get up to an additional 20% for depreciation for that specific year!

The same goes if you buy a vehicle for your business. It will show as an asset on your business’s balance sheet.

8. Be responsible when filing taxes

As a responsible earning member of the country, you should submit your tax returns before the due date. By being on time, you can utilise the full tax benefits. You can also claim further benefits in the following years.

Late filings, on the other hand, would lean to penalty and also will ruin your track record with the government.

Consider seeking professional help so that they can provide actionable recommendations on maximising your deductions. You can also use online platforms like Clear, Tax Buddy, Tax2win and more.

9. Save tax by donating

Another useful tax saving tip for small business owners is to donate to registered charities. You do a good deed AND reduce your tax burden!

Do remember to keep the receipt with you.

10. Make digital transactions

Making digital payments has two benefits.

1. Income tax deductions are prohibited for cash payments above ₹20,000 a day. If you make this payment digitally or divide it over multiple days, you can avail of the deduction.

2. Another massive benefit of digital transactions is that, even if you lose paper receipts, or are cheated, you have electronic invoices as proof of payment and the specific amount.

Having it all in one place digitally makes it 10 times easier to analyse and track your expenses and transactions.

Take your business online with Instamojo

In an economy where every penny saved is a penny earned, you need to take all the advantages you can get.

Especially when you collect thousands and thousands of rupees weekly, you need a system and easy-to-use system to record all transactions.

With Instamojo, here are all the ways that we make business easier:

- Find a record of all your transactions on your Instamojo dashboard.

- Use our invoice generator to generate invoices once you collect payments and have them sent to your email, or download them for later use.

- With our Smart Landing Pages, generate invoices automatically on payments for GST purposes

- Our partner Pabbly allows you to seamlessly generate invoices automatically every time you collect a payment. Check it out: