Finally! WhatsApp Pay is being launched in India, as per an official statement released by the messaging giant. WhatsApp has secured regulatory approval by the NPCI (National Payments Corporation of India) for launching its’s digital payment platform – WhatsApp Pay.

In its first phase, it will roll out to 10 million users. This comes 2 days after the RBI approval to launch the payments app.

WhatsApp currently has over 400 million users monthly and is running a beta version for WhatsApp payments. The messaging app was allowed to beta-test its payment feature to limited users, since February 2018. The payments feature was allowed only small-value transactions by the NPCI, which runs the UPI platform in the country.

However, things are looking up as WhatsApp pay is set to make a legal, full-fledged entry into the online payments market.

Contents

What’s currently happening with WhatsApp pay:

WhatsApp is set to overtake payment giants like Google Pay, Paytm with its already existing 400 million user base, according to a statement by Mark Zuckerberg

Since RBI requires payments data to be stored locally, WhatsApp is already working with third-party auditors to make the mandate happen. WhatsApp is approaching banks like Axis, ICICI, HDFC and SBI to offer them their payment services.

But, when will the app officially roll out WhatsApp pay to the public?

Since WhatsApp is working on creating provisions to store payments data in the country, the official rollout will be halted till August/September. This is due to the third-party audit technical requirements taking time to complete the actions.

Why did it take so long?

WhatsApp is not exactly a favourite of the Government due to the rampant misinformation that makes the rounds through forwards. And fake news.

While Google and Amazon are making larger strides in entering the digital payments world of India, WhatsApp delayed by not complying with data regulations in India.

Given its large user base, this was the perfect time for WhatsApp pay to make its entry felt. However, WhatsApp did not conform with the data localisation rule set by RBI, up until last year which slowed down the process.

Also read: Why are Whatsapp Payments not right for your business?

How to set up WhatsApp Pay:

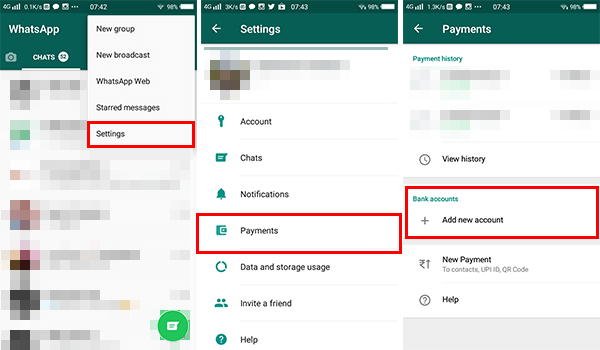

- Tap the Attachment icon in Settings —> Payment option.

- Start the setup process by tapping on the Payment icon. Accept the Terms and Privacy Policy to continue.

- Select your preferred bank to send and receive money. Many banks are yet to be listed, and WhatsApp is on an acquiring spree, given the launch date is set a few months ahead from now.

- Once you select a bank, WhatsApp asks you to select an account linked to your phone number.

- Verify your debit/ credit card details linked to the account. In every case, the WhatsApp number and bank account number should be the same.

- Set up a UPI PIN if you don’t have one. You will receive an OTP. Post this, set up a six-digit UPI PIN on your phone.

- Setup is complete and you will now be able to send and receive payments in WhatsApp.

How to use Whatsapp Pay:

Post setup, you can send and receive money from your WhatsApp contacts list. Both parties will have to have a WhatsApp Payment feature enabled to carry out transactions.

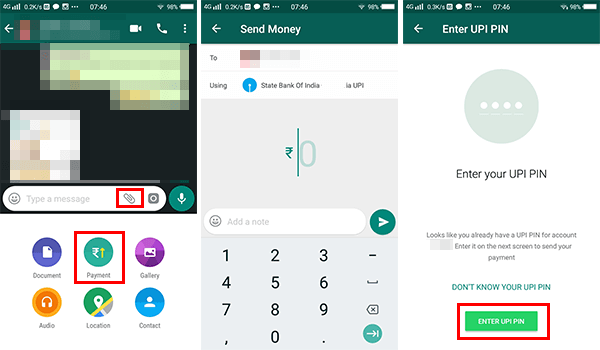

- To send money, open chat with your payee and tap on the Payment icon under the Attachment option in the text bar.

- Choose the amount (between INR 1 – INR 5000)

- Key in your UPI PIN to complete the transfer.

- The money will be sent to your contact after processing the payment.

- Status shows complete with two ticks, a sign that your money is transferred.

- You receive a similar notification when payments received from a WhatsApp contact.

Bonus: View all your payments by going to settings —> payments —> viewing history

Why is WhatsApp Payments a Good Idea?

In a recent study, WhatsApp emerged as the ideal choice of peer-to-peer communication for over 96% of Indians. The motive to expand from being a simple user-friendly messaging platform to a payments service provider is risky. However, the beta version of the app’s payment features alone got a positive buzz and even though the audience was restricted, people used it for online transactions. Users are looking for easier ways to send money to each other, and the minus of a third-party app in the picture only makes for a better online payment experience.

However, merchants can still not use the current WhatsApp pay version to carry out payments. Luckily for them, there is Instamojo. Did you know you can send and receive money on WhatsApp using Instamojo? Read all about it here.

While WhatsApp works hard to launch its payments feature, you can send and receive money on WhatsApp and other platforms through us. Create your payment link in under 2 minutes on Instamojo.

1 comment

Thanx Chethna for the info