Improved access to finance is needed to enable MSMEs to expand their scale of production and for gradual growth.

A survey by Economic times shows that SMEs in countries that can access a range of alternative financing instruments grow relatively faster. But in India, the process of MSMEs availing credit is manual and time-consuming.

To improve this, the central bank recently allowed non-banking financial companies (NBFCs) and payment system operators (PSOs) to get Aadhaar e-KYC authentication license from the Reserve Bank of India.

Contents

How Aadhaar eKYC license will ease the credit lending process

KYC today is paper-based and validation is quite a task while e-KYC, which is an OTP-based authentication, makes the entire process much faster and streamlines lending as authentication can be done instantly.

The authentication license will help in smoothing the lending process as well and also shorten the time frame for the disbursal of loans. This will also help MSME lenders fasten the time taken to onboard borrowers and disburse credit to them.

Get loans faster with RBI’s Account Aggregator framework

Account aggregator (AA) was launched last week to provide better access to the financial data of individual and business customers. It quickly saw eight major banks joining the AA network. These included State Bank of India, ICICI Bank, Axis Bank, IDFC First Bank, Kotak Mahindra Bank, HDFC Bank, IndusInd Bank, and Federal Bank.

Also read: 5 Ways to Identify Fraud Loan Apps and Avoid Losses for Small Businesses

Here’s all you need to know about the account aggregator (AA) framework and how it works:

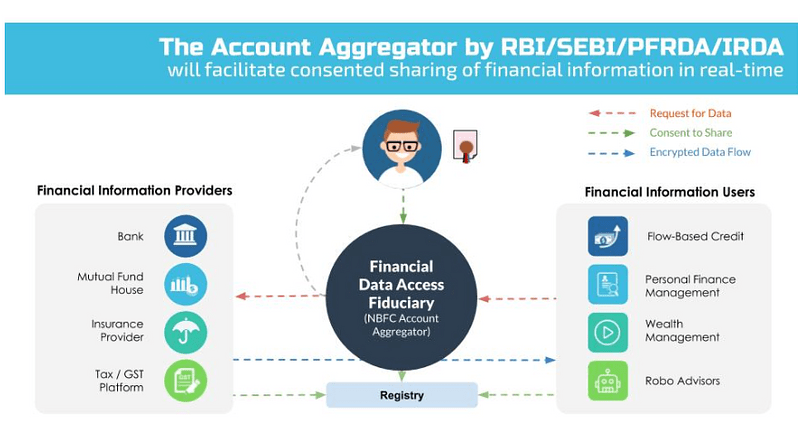

In simple terms, the AA platform allows the data of individuals to be collected, with their consent, and shared among financial institutions.

This gives the institutions a better understanding of potential customers and tailor their services accordingly. It also enables the free flow of data between banks and financial service providers.

How will the new Account Aggregator network improve an average person’s financial life?

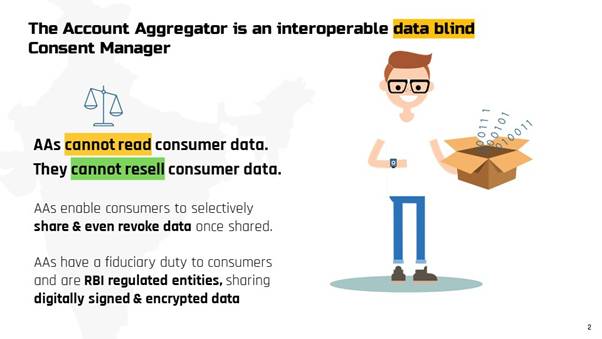

India’s financial system involves many hassles for individuals and small businesses today — sharing physical signed and scanned copies of bank statements, stamp documents, sharing your personal details, and more. The Account Aggregator network would replace all these with a simple, mobile-based, simple, and safe digital data access & sharing process. This will create opportunities for new kinds of services.

What new services can you access if your bank has joined the AA network?

The two key services that will be improved are access to loans and access to money management. If you want to get a small business loan or personal loan today, there are many documents that need to be shared with the lender. This is a cumbersome and manual process, which affects the time taken to procure the loan and access to a loan.

Through Account Aggregator, a company can access tamper-proof secure data quickly and cheaply and fast-track the loan evaluation process so that a customer can get a loan.

Also, a customer may be able to access a loan without physical collateral, by sharing trusted information on a future invoice or cash flow directly from a government system like GST or GeM.

Related read: How to access the Government’s Emergency Credit Scheme to Restart Business

The AA network: Step-by-step process explained

Step one is to open an account with a banl that has joined the account aggregator network. Then, a funnel is created of all your financial data by linking your bank accounts, insurance policies, etc.

Step two, you provide consent to a lender to access their financial data through the NBFC-AA. This usually happens when you are looking for a loan for your business.

Third, after consent is provided, the account aggregator seeks permission from the financial data providers to access the customer’s data.

And finally, the data is sent to the account aggregator, which, in turn, empowers lenders to better evaluate your business’s financial profile and risk associated with providing a loan.

The need for AAs

With the improved access to data, pressing financial needs such as small-size loans for MSMEs could be better met with the help of the AA framework.

For MSMEs, which collectively face a credit gap, providing improved access to their financial data can help bring more visibility towards their creditworthiness.

As a majority of MSMEs are largely outside the scope of formal credit due to the lack of transparent and accessible financial records, the AA framework can help regulate, digitize, and simplify the process of opening up access to financial data.

Consequently, this improved access can help lenders better meet the MSMEs’ financial needs.

Learn more about the Account Aggregator Network here.

Need capital for your business? We have you covered.

Instamojo loans are the fastest way to get a loan in your bank account without a credit score. Applying for loans is now no more a headache! – no paperwork, instant approval, 24-hrs disbursal. To apply for a loan, download the Instamojo Android App today!