Quick summary:

Acquiring new customers is essential for any business, but it comes at a cost. This blog will provide a comprehensive overview on what is customer acquisition cost (CAC).

- You’ll understand why calculating and optimizing CAC is crucial for measuring marketing ROI, forecasting costs, demonstrating scalability, and driving profitable growth.

- Get familiar with the components of CAC, the formula for calculating it for your business, and benchmark data on average costs across industries.

- Most importantly, you’ll learn proven strategies to lower your CAC through more effective sales and marketing tactics.

By the end, you’ll grasp the importance of this metric and have a clear framework for getting your arms around this make-or-break number.

Let’s keep the ball rolling if this excites you to learn a new concept!

Contents

What is customer acquisition cost?

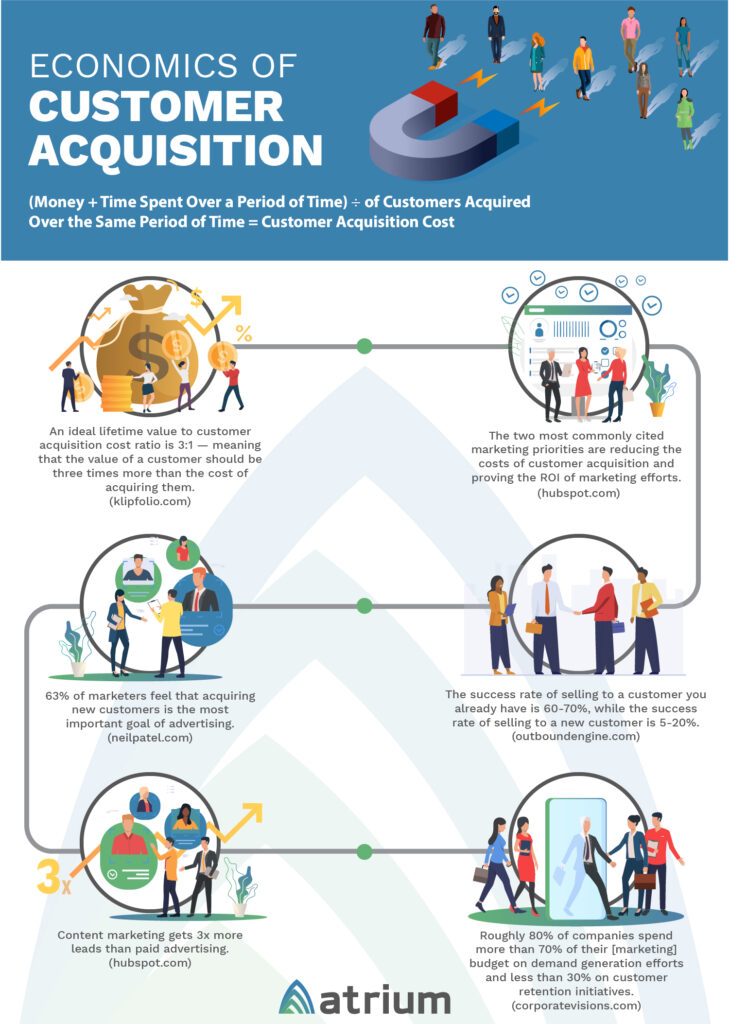

Customer acquisition cost (CAC) refers to the total costs of convincing a potential customer to purchase your product or service.

This includes expenses like marketing, advertising, sales commissions, and any other resources used to attract new buyers.

Calculating CAC is crucial because it allows businesses to gauge the ROI of their sales and marketing efforts.

- A lower CAC means you spend less to acquire new customers

- While a higher CAC may indicate inefficient spending or misaligned strategies

According to SaaS Capital, the median CAC for subscription businesses was $102.

Tracking and optimising CAC over time helps ensure you’re cost-effectively driving sustainable growth. With payment solutions like Instamojo streamlining sales processes, you can better control customer acquisition costs.

Why is CAC important?

You may be wondering why CAC analytics is such a big deal for your business. Well, let us tell you – understanding your customer acquisition cost is essential for a few major reasons:

Marketing campaigns

Figuring out your customer acquisition cost is vital because it shows you how well your marketing and sales efforts are paying off in attracting new buyers. If that number is low, your acquisition strategies are efficient and generate a solid return on investment.

Setting budgets

Tracking CAC is also helpful for forecasting future costs and setting intelligent budgets. Once you know your average CAC, you can predict pretty accurately how much you’ll need to spend to convert your new target audience for a given period. This guides your marketing and sales budget planning.

Shows scaling

Having a low and steadily decreasing customer acquisition cost is a signal that your business model is primed to scale rapidly. It means your sales process is operating efficiently and bringing in new customers cost-effectively, which is essential for sustainable high growth.

Highlights underlying operational issues

Conversely, if your CAC is high or creeping upwards, it could indicate some underlying operational issues you need to address. These could include ineffective marketing campaigns, a slow sales cycle that is dragging on, or other inefficiencies driving up acquisition costs. Monitoring CAC closely helps catch those red flags early.

Investors love it

Investors also pay close attention to CAC as a critical performance metric that impacts valuation and funding. A trending down CAC demonstrates strong product-market fit and severe growth potential, which VCs love to see. It shows you’ve got a solid grasp on scaling up affordably.

It’s also worth considering how customer acquisition can vary depending on your channels and platforms. Instamojo’s powerful analytics give your CAC complete visibility across marketing channels.

Customer acquisition cost formula

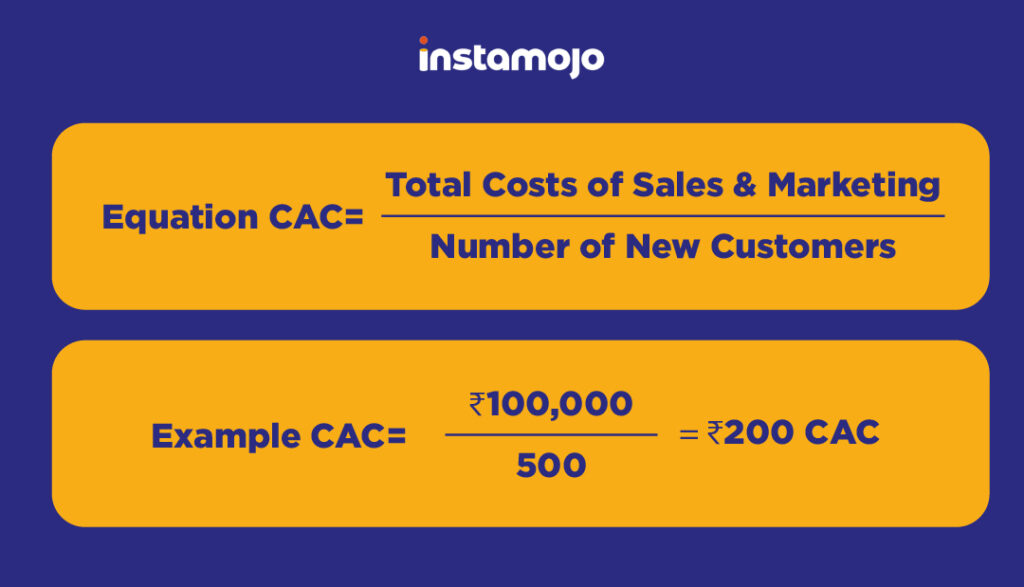

The formula to calculate it is pretty straightforward:

CAC = Total costs of sales & marketing / Number of new customers

First, you must sum up all the costs of acquiring new customers over a set period—maybe a quarter or a year. This includes advertising spend, content marketing, email campaigns, sales representative salaries and commissions, marketing tools like your CRM, and other related expenses.

Then, you divide the total cost by the number of new paying customers you brought in during the same period.

The final amount is the money you are spending on convincing a single customer to purchase your product or service.

Cost of customer acquisition examples

Let’s say your total sales and marketing costs were ₹100,000 last quarter, and you acquired 500 new customers.

Simple math gives us:

So it costs you ₹200 to acquire each new customer that quarter. Not too shabby! The lower you can keep your CAC, the higher your return on those sales and marketing investments.

Calculating your CAC regularly to track whether it’s trending up or down over time is a good practice. This gives you a clear window into whether your customer acquisition strategies are becoming more or less efficient.

What is included in it?

Customer acquisition costs encompass a wide range of expenses for attracting and converting new customers. What are they? Let’s find out!

Marketing costs:

- Advertising (PPC, social media ads, etc.)

- Content marketing (blogs, videos, etc.)

- Email marketing campaigns

- Events and trade shows

Sales costs:

- Salaries of sales reps

- Sales commissions

- Customer relationship management (CRM) tools

Technical costs:

- Website optimisation and design

- Landing page builders

- Marketing automation software

Other costs:

- Customer research and data analysis

- Promotional offers and discounts

Accurately tracking and totalling all these costs is critical to calculating your true customer acquisition cost.

Average customer acquisition cost by industry

According to a 2022 report by IMAP India, the average customer acquisition cost for Indian startups across sectors was around ₹1,200-1,500 ($15-20 USD).

Some industry benchmarks for India include:

- Travel: ₹580

- Retail: ₹830

- Consumer goods: ₹1,825

- Manufacturing: ₹6,880

- Transportation: ₹8,125

- Marketing agency: ₹11,685

- Financial: ₹14,500

- Technology (Hardware): ₹15,080

- Real estate: ₹17,645

- Banking/Insurance: ₹25,110

- Telecom: ₹26,100

- Technology (Software): ₹32,765

Wrapping up: Optimise your customer acquisition costs for growth

Mastering your customer acquisition cost is pivotal for scaling a profitable, sustainable business. With a firm grasp on the components driving up your CAC, you can precisely measure marketing ROI, forecast costs, identify inefficiencies, and demonstrate an efficient acquisition model to investors.

Instamojo’s online store, the payment solutions and powerful analytics provide complete visibility into your CAC across channels, allowing you to streamline processes and double down on tactics that keep this critical metric in an ideal range.

Ultimately, leveraging Instamojo to enhance your CAC relentlessly will propel cost-effective, scalable growth for years to come.